Advertisement

Advertisement

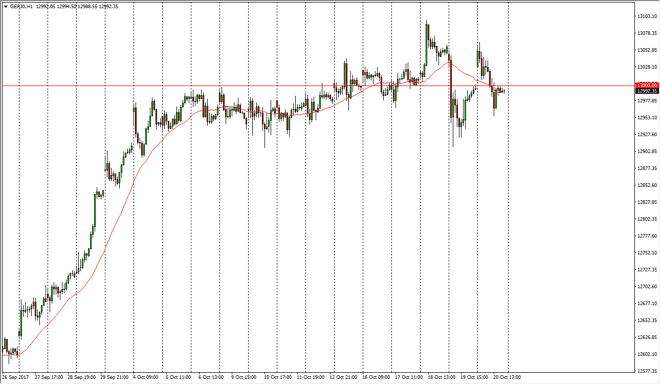

DAX Index Price Forecast October 23, 2017, Technical Analysis

Updated: Oct 21, 2017, 07:19 GMT+00:00

The German index gapped higher at the open on Friday, shot towards the €13,050 level, and then pulled back to not only filled the gap, but to break down

The German index gapped higher at the open on Friday, shot towards the €13,050 level, and then pulled back to not only filled the gap, but to break down below it. We rallied from there to test the €13,000 level above, which is now offering significant resistance. Because of this, I think that the market will roll over a bit, but I also recognize that there’s a lot of support in the DAX. The EUR/USD pair looks as if it is trying to break down, and if it does that should help the DAX as well, as it is highly sensitive to currency headwinds when it comes to German exporters. I believe that the market continues to be volatile to say the least, but I think longer-term we will find buyers. Because of this, I am willing to add to long positions that show profit, as I think we will eventually go looking towards the €15,000 level over the longer term.

If we break down, I suspect that it could be a rather vicious and sudden fall from the €12,900 level, but it will be a short-term selling opportunity more than anything else. Ultimately, this is a market that continues to favor the upside, so that breakdown would be a bit of a surprise, and would probably have a catalyst that would be obvious. Currently, it doesn’t seem as if there is one, so I think that the most likely scenario is that we eventually build up enough momentum to go higher. Once we do, I suspect that we will target the €15,000 level next year, with particular interest at the €13,250 level in the next few months. There is no need to jump in with both feet, build your positions up slowly.

DAX Video 23.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement