Advertisement

Advertisement

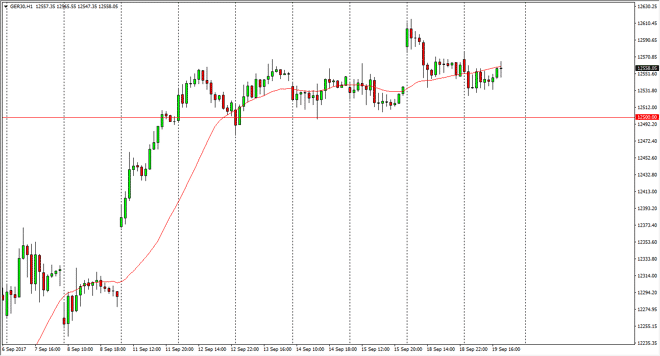

DAX Index Price Forecast September 20, 2017, Technical Analysis

Updated: Sep 20, 2017, 04:50 GMT+00:00

The German index went sideways during the session on Tuesday, as the €12,500 level underneath continues to be massively supportive. I believe that the

The German index went sideways during the session on Tuesday, as the €12,500 level underneath continues to be massively supportive. I believe that the market will continue to go higher, as we gapped higher on Monday, and now have fallen backwards to fill that gap. The gap looks as if it is holding, so I believe that the DAX is a market that’s willing to buy. The €12,500 level should continue to see massive support, and even if we break down below there I think that the “floor” is closer to the €12,300 level. A break above the €12,600 level should send this market much higher and more of a “buy-and-hold” situation. I believe the dips are simply value waiting to happen, and therefore I treat them as such.

Buying slowly and incrementally

I believe that if you buy the DAX on short-term dips and in smaller pieces, I think that you could build up a large position, and an opportunity to build your account on what has been a very strong uptrend. The €13,000 level above should be the longer-term target, but I think that it’s only a matter of time before we break above there also. After all, the European Union has been recovering for some time, and I think that starting to show itself in the DAX, which is the blue-chip stock market for the EU.

I have no interest in shorting this market, least not until we were to break down below the €12,250 level, which seems very unlikely to happen. Ultimately, I believe that the market is one that should offer plenty of opportunities going forward, so by not jumping in and buying in one move, you have the ability to build up a much larger position, if you have the patience.

DAX Video 20.9.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement