Advertisement

Advertisement

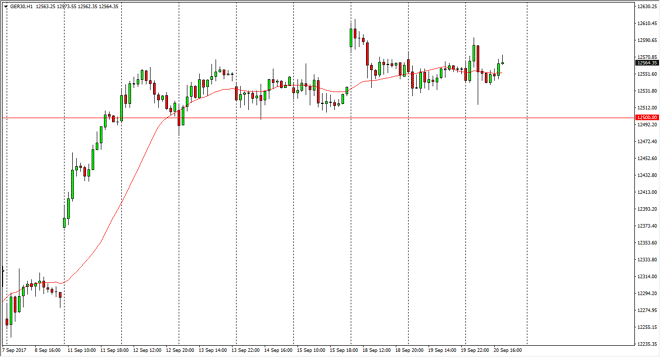

DAX Index Price Forecast September 21, 2017, Technical Analysis

Updated: Sep 21, 2017, 06:08 GMT+00:00

The German index has gone sideways during the session on Wednesday, as we continue to hover above the €12,500 level. That’s a sign of stability after a

The German index has gone sideways during the session on Wednesday, as we continue to hover above the €12,500 level. That’s a sign of stability after a very impulsive move to the upside, thereby giving me more confidence in the uptrend than ever. We have filled the gap from the open on Monday, and should continue to see buyers jump into this market and eventually break out. I know that the EUR/USD pair is going to be very important, but at the end of the day I think that a market that reflects a stronger European Union is what we are going to see here at the DAX. I think pullbacks offer nice buying opportunities, and that the €12,500 level should continue to offer support. However, if we were to break down below there I think there is more than enough support at the €12,300 level to keep the market afloat as well.

Short-term pullbacks offer buying opportunities

I believe that short-term pullbacks offer buying opportunities in a market that has been strong for some time. Ultimately, I believe that we are going to go looking for the €13,000 level, which is a large, round, psychologically significant number. With this in mind, I am a buyer of these dips, and I do think that eventually we break above the €13,000 level and continue to go much higher. The German economy has been showing signs of strength as the European Union has, and of course this is the bellwether of the European Union. Ultimately, it is not until we break down below the €12,250 level that I would consider selling this market, and I look at dips again, as a nice buying opportunity in a market that has been fairly reliable and extraordinarily stable over the last several sessions.

DAX Video 21.9.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement