Advertisement

Advertisement

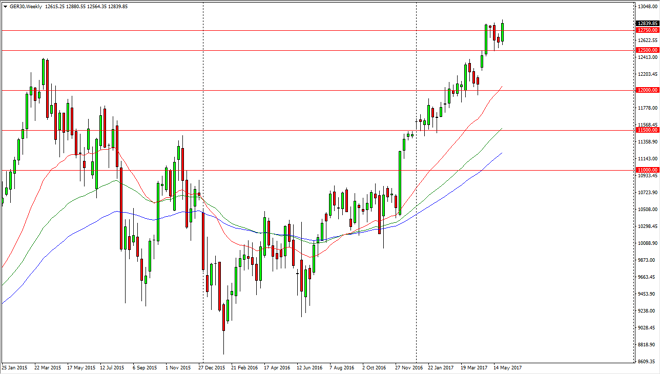

DAX Index Price Forecast for the Week of June 5, 2017, Technical Analysis

Updated: Jun 4, 2017, 10:50 GMT+00:00

The DAX Index initially dropped at the open on Monday, but spent the rest of the week break out to the upside. We made a fresh, new, high in the market,

The DAX Index initially dropped at the open on Monday, but spent the rest of the week break out to the upside. We made a fresh, new, high in the market, and it looks as if pullbacks will continue to be bought as the DAX seems to be very well supported just below at the €12,500 level. I believe that the market will probably continue to reach towards the €13,000 level above, and that the bullish attitude continues to be what we see in this market, as we have seen a significant move over the last several months. I believe that we will not only reach towards the 13,000 level, but break above there given enough time. The DAX of course is where money flows into the European Union first, as it is the blue-chip stock index.

Global growth

Global growth continues to look very healthy, and that being the case, it’s likely that the market will continue to favor the upside just as we have seen in the other indices, and I don’t see why the DAX would stand out as being different. Yes, the jobs number in America was less than ideal during the week, but quite frankly the stock markets over there have already reclaimed all of their losses, so that should simply not figure into the DAX going forward. Selling is all but impossible, and buying on the dips is the best way to trade an uptrend like this as you know. While I don’t necessarily think it will be a straight line higher, it certainly won’t be a market that can’t be sold anytime soon, as the market has been so bullish over the last several months. I prefer the DAX over most other indices.

DAX Video 05.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement