Advertisement

Advertisement

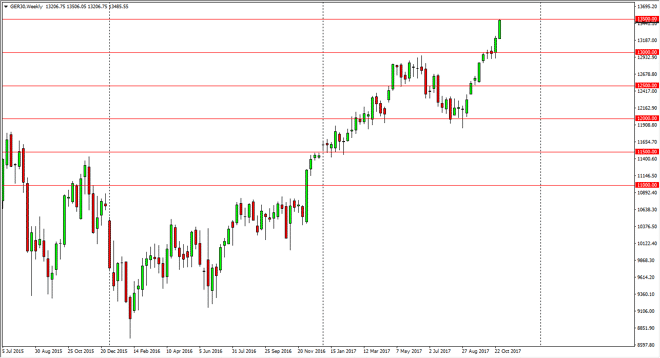

DAX Index Price forecast for the week of November 6, 2017, Technical Analysis

Updated: Nov 4, 2017, 06:16 GMT+00:00

The German index rallied significantly during the week, reaching towards the €13,500 level. That is an area that of course has a certain amount of

The German index rallied significantly during the week, reaching towards the €13,500 level. That is an area that of course has a certain amount of psychological resistance built in, and although we are a bit bullish at this point, I think we are a bit overextended as well, I think a pullback makes a lot of sense, and it could extend all the way back to the €13,000 level. Quite frankly, I look at short-term pullbacks as nice buying opportunities in a very strong uptrend. The €13,000 level should be the “floor” in the market, as it was massively resistive in the past. I think that eventually we go to the €14,000 level, and then possibly the €15,000 level. Overall, this is a market that should continue to offer value, especially if the EUR/USD currency pair continues to drop like I think it will.

Longer-term, the EUR/USD pair should drop to the 1.13 level underneath, which was previously resistive. It’s also the 50% retracement level in the currency pair, so I think if we’re going to continue to go towards that area, this market should continue to go much higher. I think if we can break above the €13,500 level, the market should then go much higher, perhaps in and impulsive move. I prefer the pullbacks though, because they offer value, which is something you should always look for when dealing with any type of financial estimate, let alone equities.

If we were to break down below the €13,000 level, the market should then break down rather significantly. I think that there is more than enough buying underneath to keep this market afloat though, and that is the least likely of the potential moves that will be coming.

DAX Video 06.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement