Advertisement

Advertisement

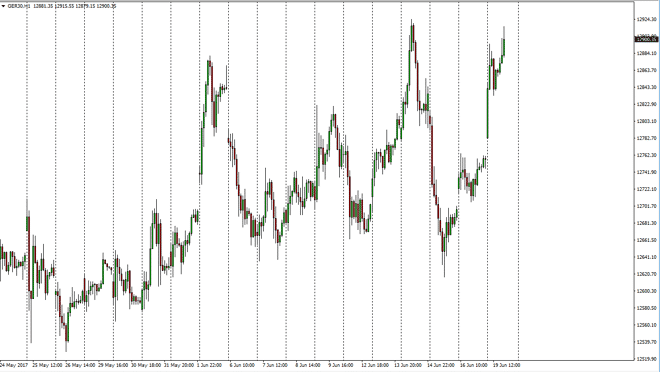

DAX Index Price June 20, 2017, Technical Analysis

Updated: Jun 20, 2017, 05:08 GMT+00:00

The German index gapped higher at the open on Monday, and then exploded to the upside to reach towards the €12,900 level. I believe that short-term

The German index gapped higher at the open on Monday, and then exploded to the upside to reach towards the €12,900 level. I believe that short-term pullbacks continue to be buying opportunities as the market looks very bullish, and should go looking towards the €13,000 level. The market continues to be one that offers value every time it pulls back, and a break above the €13,000 level should send the market much higher. The gap below at the open on Monday should be supportive, and I will look at it as such. The EUR/USD pair falling could also help the idea of exports coming out of Germany, which of course helps the idea of the DAX as well. On top of that, the German index is where money goes to first to invest in the European Union.

Buying dips

I believe in buying dips going forward, and I think that’s the only way to play this market because of the explosive move to the upside, and the market has been a bit overextended. Looking for value on pullbacks is probably the best would play this market, as we offer value every time we drop, and I do not think that the sellers are going to pick up any serious traction anytime soon. It appears that stock markets around the world continue to be bullish, and the DAX is one of the “safer” plays.

I break above the 13,000 level should send this market to the €13,250 level, and perhaps even higher than that. Ultimately, the market looks to be reaching towards the next leg higher from a longer-term perspective, and that’s what I’m banking on when it comes to the DAX going forward.

DAX Video 20.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement