Advertisement

Advertisement

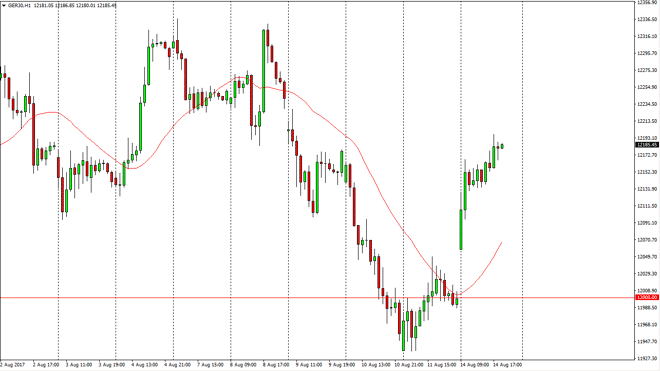

DAX Price Forecast August 15, 2017, Technical Analysis

Updated: Aug 15, 2017, 05:22 GMT+00:00

The German index gapped at the open on Monday to the upside, as the €12,000 level has offered significant support. Because of this, it looks like we are

The German index gapped at the open on Monday to the upside, as the €12,000 level has offered significant support. Because of this, it looks like we are ready to continue going higher, and I believe that the uptrend has been saved. A lot of the selling has been due to risk aversion and markets been a bit frothy. Quite frankly, they needed a reason to pull back in the DAX did just that. However, now that we have seen such an explosive Monday, I believe that this market will probably continue to go to the upside, so I like buying dips. I also recognize that the €12,000 level has been confirmed, and that being the case it offers a bit of a “floor” for me. I think that we’re going to go looking towards the €12,250 level next, and then eventually the €12,500 level after that.

EUR/USD currency headwinds

There is a possible currency had one coming out of the EUR/USD pair, which seems to be going higher. Because of this, it does affect German exports, but it also is a symptom of a stronger European Union, which in the longer term is going to be better for the DAX. Because of this, I believe that we are going to continue to go higher but it’s also going to be very noisy. I like pullbacks as it gives me an opportunity to pick up the position and add to the position in small increments. I like the CFD markets, and of course options. Going directly to the futures market could be a bit more difficult, just because of the volatility. At that point though, comes down to your account size, and therefore the decision should be based upon the ability to deal with what will be choppy conditions.

DAX Video 15.8.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement