Advertisement

Advertisement

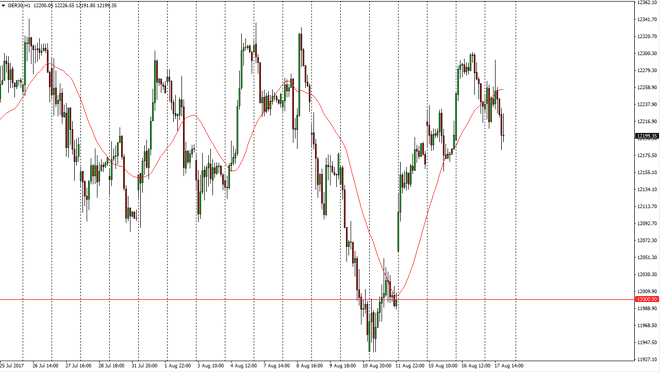

DAX Price Forecast August 18, 2017, Technical Analysis

Updated: Aug 18, 2017, 05:33 GMT+00:00

The German index was very volatile during the day on Thursday, as we continue to bounce around the €12,200 region. Currently, there is a gap below that

The German index was very volatile during the day on Thursday, as we continue to bounce around the €12,200 region. Currently, there is a gap below that sits just above the €12,000 level, and that is the “floor” of the market. This makes the €12,000 level underneath even more vital than previously thought. I am looking to buy some type of bounce, and there are several places where I could see it happening, but it should occur between here and that level. Ultimately, I expect this market to go to the €12,500 level above, as it is a nice juicy target for the buyers. The EUR/USD pair rising over the last several weeks has been a bit of a drag on German exports, at least in theory, so therefore that might be part of the reason we are seeing a little bit of pressure. Also, the ECB looks likely to taper from quantitative easing a bit, and that could also have an effect on the DAX.

Longer-term fundamentals

Longer-term fundamentals dictate that the European Union is doing a bit better than previously thought, so it is likely that the DAX will find buyers given enough time. By entering the market slowly, you can add to positions as they increase in value, making sure that you’re on the right side of the trade in general. I think that eventually we will go looking towards the aforementioned €12,500 level, and then possibly €13,000 after that. If we were to break down below the lows seen last week, that would be a very negative sign, and probably have this market falling rather precipitously. I don’t think that’s going to happen currently, but I always try to keep the other side of the possible equation on the forefront of my mind.

DAX Video 18.8.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement