Advertisement

Advertisement

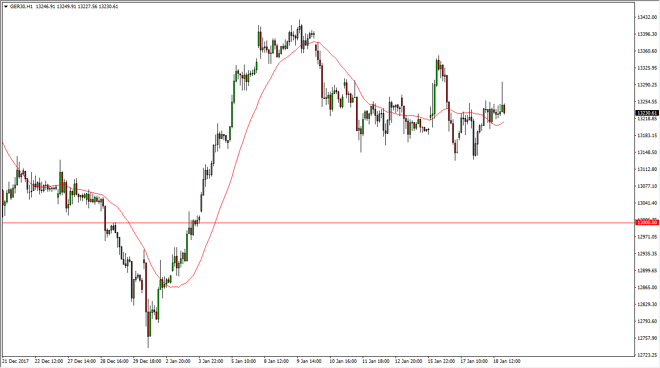

DAX Price Forecast January 19, 2018, Technical Analysis

Updated: Jan 19, 2018, 05:50 GMT+00:00

The German index has been very noisy over the last several sessions, essentially going nowhere though. That of course is common, after seeing a move to the upside that has recently occurred. The 24-hour exponential moving average also tells us that we are going sideways.

The German index went sideways overall, as we continue to see the market go back and forth. I think that the DAX will of course be bullish longer term, but currently I think we are trying to build up the necessary momentum to continue going higher. The €13,000 level underneath is essentially what I look at as the “floor” in the market, and it is not until we break down below there significantly that I would consider selling. Remember, the DAX is one of the first places that Europeans put money to work, and more importantly: foreign investors put money to work in Europe.

Longer-term, I fully anticipate that the DAX is going to go looking towards the €15,000 level, but it’s going to take some time to get there. I think that pullbacks are buying opportunities, and that’s what we are seeing right now, a pullback that is based upon consolidation and an opportunity to find value that I can start to build up on. The market will be noisy, but if you are patient, the longer-term trend should maintain itself, and give you plenty of profits down the road. Slow and steady wins the race when it comes to the DAX.

If we break down below the €13,000 level, then the market could go as low as the €12,750 level rather rapidly. Again though, that is the least likely of scenarios and as the moving average is starting to flatten out, this tells me that we are simply going to tread water until we get another catalyst to have more people jump into the fray.

DAX Video 19.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement