Advertisement

Advertisement

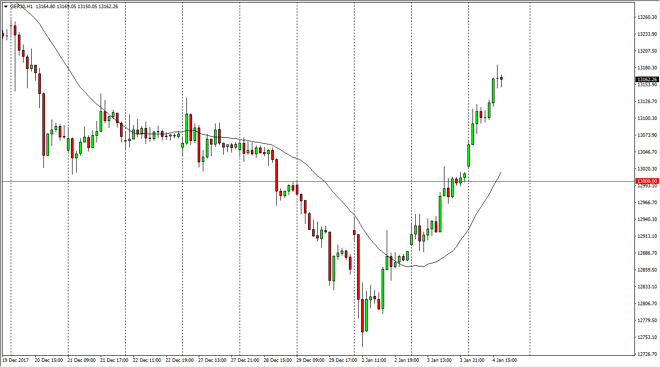

DAX Price Forecast January 5, 2018, Technical Analysis

Updated: Jan 5, 2018, 08:18 GMT+00:00

The German index gapped higher at the open on Thursday, and then exploded to the upside, breaking will above the €13,100 level. That’s an area that being broken above was a very strong signal that we are going to go much higher.

The German index has exploded to the upside during the trading session on Thursday, clearing the €13,100 level. That’s an area that had previously been resistive, and now that we have broken above there, I think the DAX has shown its resiliency, and its likelihood to continue to go much higher. I think that the €13,250 level will be the next target, just as now the €13,000 level should be support. I think given enough time, money will continue to flow into the German index, because it is the epicenter of all things European Union.

If we were to break down below the €12,900 level, it would be a very negative sign, but at this point I think the buyers have made their point, and that we are going to continue to see plenty of bullish pressure. I believe that the markets continue to offer value on these dips, and I think that the market will eventually go looking towards the €15,000 level longer term. In the meantime, dips are opportunities to pick up value, as the DAX has been so strong over the last couple of years. I believe that the DAX will continue to be favored as the EU looks healthy, and this of course suggests that Germany will continue to be the epicenter of the investment world when it comes to the EU, so I believe that as we continue to see growing strength in the European Union, the DAX will continue to attract a lot of money. What’s great about the DAX is that you can use it as a barometer for other European indices, so even if you don’t trade the DAX, you can use the index as a barometer to trade the MIB, the ASX, and other such as the CAC.

DAX Video 05.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement