Advertisement

Advertisement

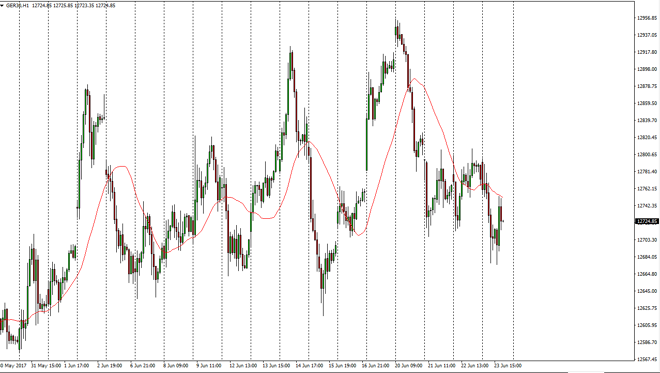

DAX Price Forecast June 26, 2017, Technical Analysis

Updated: Jun 24, 2017, 05:13 GMT+00:00

The German index initially fell significantly during the day on Friday, reaching down to the €12,650 level. We bounce from there and have now reentered

The German index initially fell significantly during the day on Friday, reaching down to the €12,650 level. We bounce from there and have now reentered the previous consolidation area. Because of this, I think we will continue to see a significant amount of volatility but I still favor the DAX longer term. If we can break above the €12,800 level, I’m very comfortable buying this market as it should then go to the €12,950 level. Pay attention to headlines coming out of Euro, but in general they look reasonably positive as the markets have been favoring the DAX for some time, after all it’s the blue-chip index for the European Union. The market is difficult to deal with when it’s this volatile, but longer-term we do continue to go higher.

Looking for value

I believe that the market continues to be one that you should probably enter incrementally, as it will help you deal with the massive amount of choppiness. I think longer-term that the market will go looking for the €13,000 level, and longer-term charts I feel suggests that we are going to that area. Ultimately, the €12,500 level underneath would be massively supportive, and it’s not until we break down below that level that I would be interested in shorting this market, especially aiming for the €12,000 level after that.

Keep in mind that money is flowing into the European Union, and Germany as one of the first places it will go to as it is one of the more stable markets. German exports are a huge factor in this index, and I think that should continue to be the way the you should be looking at it, as experts flowing out of Germany and into the rest of the world.

DAX Video 26.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement