Advertisement

Advertisement

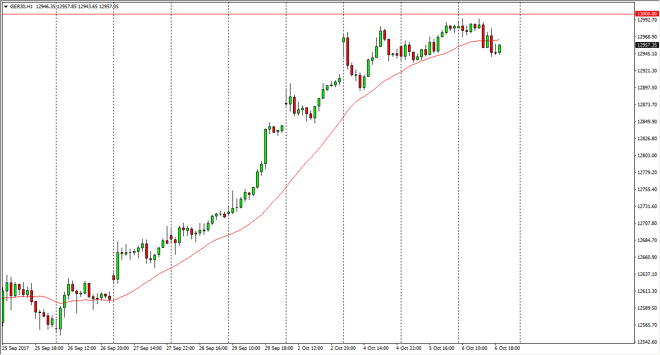

DAX Price Forecast October 9, 2017, Technical Analysis

Updated: Oct 7, 2017, 06:28 GMT+00:00

The German index initially went sideways during the trading session on Friday, but then did the little bit to reach towards the €12,950 level. The market

The German index initially went sideways during the trading session on Friday, but then did the little bit to reach towards the €12,950 level. The market looks likely to reach towards the €13,000 level above, which has been a massive barrier. If we can break above that level, it’s likely that the market will continue to go much higher, perhaps reaching towards the €14,000 level given enough time. I believe that the DAX will continue to lead the way for the rest of the European Union, as it is considered to be the “blue-chip index” of that region. As the German economy has been doing quite well, it makes sense that the DAX should continue to do well also. A strengthening Euro doesn’t help necessarily, but it seems as if the market is willing to deal with that based upon short-term charts.

I believe that longer-term, we are trying to build up enough momentum to finally break out to the upside, and that these pullbacks are simply an opportunity to pick up a bit of value. I think that eventually we will break out, and that more money will go flowing into this market place as it allows for a bit of comfort to finally have the break out. If we were to break down from here, I think that there is plenty of support at the €12,800 level as well, and I think that the buyers would be looking at that level next if we did fall. I don’t have any interest in shorting this market currently, although I do recognize that a bit of sideways action may be what we are getting ready to see. That isn’t necessarily a bad thing though, as it allows the market to catch his breath after such a strong move higher.

DAX Video 09.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement