Advertisement

Advertisement

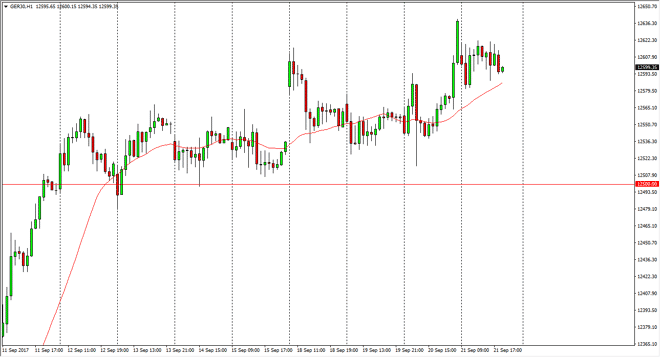

DAX Price Forecast September 22, 2017, Technical Analysis

Updated: Sep 22, 2017, 06:50 GMT+00:00

The German index had a quiet session after initially gapping lower on Thursday, as we continue to tread water around the €12,600 level. The market is

The German index had a quiet session after initially gapping lower on Thursday, as we continue to tread water around the €12,600 level. The market is still in an uptrend, and I think is still very heavily supported underneath. In fact, I believe that the 12,500 level is starting to offer a bit of a floor, and I think that dips will continue to be buying opportunities. I have a longer-term target of €13,000, but it may take a while to get there. In the meantime, I look at buying opportunities as an opportunity to add to a position slowly. The market should continue to find plenty of interest from traders as the German economy outperforms the rest of the EU.

As goes Germany, goes the EU

Keep in mind that Germany is considered to be a bit of a bellwether for the European Union, and as the EU goes, so does Germany, and of course vice versa. Currently, it appears that traders are betting on the European Union strengthening, and that should be good for the DAX going forward. I believe that the market will continue to find plenty of buyers, and I also believe that it should lead the way for most other indices around the world. The DAX is considered to be one of the “safer” markets, and I believe that we should continue to see the buying pressure present itself as an opportunity to build a large position. Ultimately, I would not be surprised to see the DAX go looking for the €15,000 level above, but that of course is a longer-term call. If we were to break down below the €12,500 level, I think that there is a gap below that is near the €12,300 level that should offer support.

DAX Video 22.9.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement