Advertisement

Advertisement

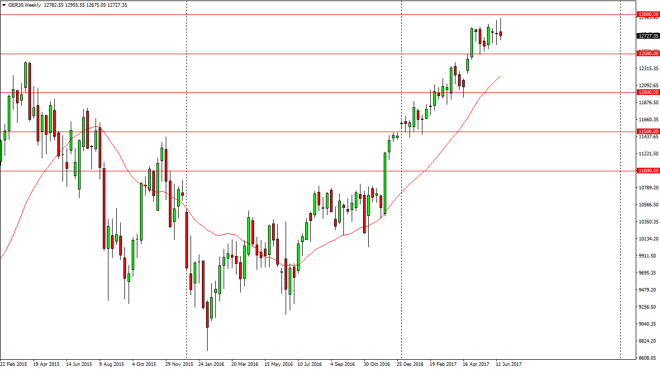

DAX Price forecast for the week of June 26, 2017, Technical Analysis

Updated: Jun 24, 2017, 05:16 GMT+00:00

The German index initially tried to rally during the week but continues to find the area near the 13,000 handle to be a bit resistant. That makes sense,

The German index initially tried to rally during the week but continues to find the area near the 13,000 handle to be a bit resistant. That makes sense, we are a little bit overextended but I think it’s only a matter of time before the buyers return as the 12,500 level looks to be supportive, just as the 12,000 handle is. Looking at this market, I think although we are bit overextended, it’s very likely that the bullish pressure should continue the longer we go into the year, and I believe that given enough time we will break above the 13,000 handle, and then reached a much higher level. I have no interest in shorting unless of course we break down below the 12,000 handle, which seems very unlikely to happen anytime soon.

Having said that, it’s an exhaustive candle this week

We have formed a bit of an exhaustive candle for the week, so it looks like we could pull back. However, I think that the pullback offers value that people can take advantage of, and ultimately that should send the market looking for opportunity. I think that the DAX goes to the 14,000 handle, and then eventually 15,000. I would and in small increments in order to take advantage of the overall attitude of the DAX, and I believe that we will eventually continue to see money floating into the European Union, via Germany of course. The Germans are considered to be the “blue-chip” index, and as long as that’s the case it should continue to be the first place money flows to.

DAX Video 26.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement