Advertisement

Advertisement

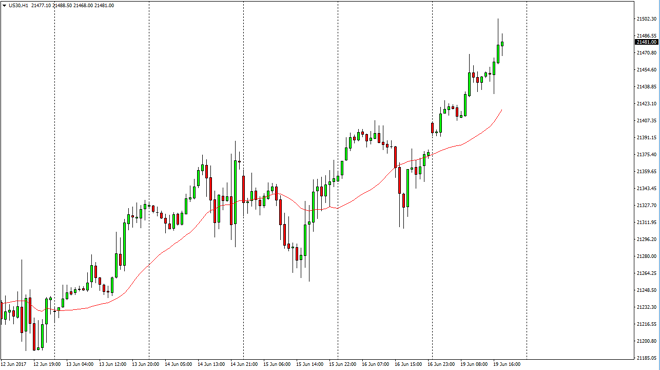

Dow Jones 30 and NASDAQ 100 Forecast June 20, 2017, Technical Analysis

Updated: Jun 20, 2017, 05:08 GMT+00:00

Dow Jones 30 The Dow Jones 30 gapped higher at the open on Monday, and then shot towards the upside. The 21,500 level above has offered a significant

Dow Jones 30

The Dow Jones 30 gapped higher at the open on Monday, and then shot towards the upside. The 21,500 level above has offered a significant amount of resistance, but I do think we break above there over the longer-term. With this being the case, I’m looking to buy pullbacks as the US indices all look likely to go higher over the longer-term, and of course we have seen a bullish move right at the beginning of the session on Monday. So, with this, I am a buyer of not only this index, but US indices in general. Given enough time, I think that the market reaches towards the 21,750 level next. I have no interest in shorting.

Dow Jones 30 and NASDAQ Index Video 20.6.17

NASDAQ 100

The NASDAQ 100 exploded to the upside on Monday, and broke above the 5750 level. Having said that, it looks as if the NASDAQ 100 continues to rebound and recuperate from the massive selloff that we had seen recently. Because of this, I am a buyer on dips and I believe that we will break out to the upside, eventually reaching towards the 5900 level above, and then the 6000 level. I have no interest in shorting this market, as it has been so strong over the last several sessions, and of course seems to have found its bottom. This is a market that had gotten oversold, and as “a rising tide lifts all boats”, I believe that the other US indices rallying should continue to push this market higher as well in a sort of “knock on effect” in the markets.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement