Advertisement

Advertisement

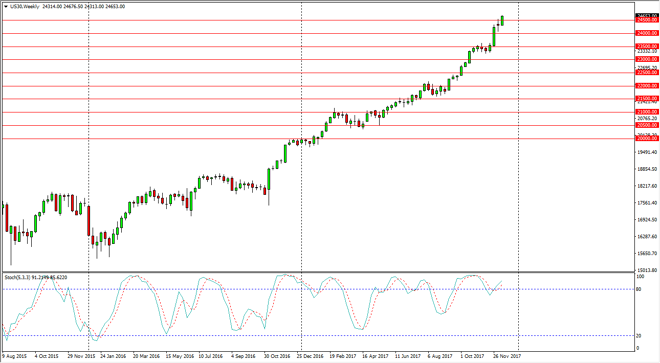

Dow Jones 30 and NASDAQ 100 forecast for the week of December 15, 2017, Technical Analysis

Updated: Dec 16, 2017, 05:06 GMT+00:00

Dow Jones 30 The Dow Jones 30 broke higher during the week, clearing the top of the neutral candle from the previous week. In fact, we are at fresh, new

Dow Jones 30

The Dow Jones 30 broke higher during the week, clearing the top of the neutral candle from the previous week. In fact, we are at fresh, new highs, and I think at this point it is all but a given that we are going to go to the 25,000 handle. I have no interest whatsoever in shorting this market, and I believe that the 24,000-level underneath should be massively supportive. This market looks likely to be a “buy on the dips” market as the Santa Claus rally continues. Once we break above the 25,000 handle, we are free to go much higher. Granted, we are a bit overbought, but I think every time we pull back it represents quite a bit of value the people will be willing to take advantage of.

Dow Jones 30 and NASDAQ Index Video 18.12.17

NASDAQ 100

The NASDAQ 100 broke above the top of the hammer from the previous week, and more importantly, the 6400 level. By closing above that level, and breaking out to a fresh, new high, it’s likely that we should continue to go higher, and target the most obvious target: the 6500 level. There is a significant amount of psychological importance to that level, so it’s likely that we will continue to see interest in this market until we get there. I think pullbacks continue to be supported by the uptrend line on the chart as well, so at this point it looks as if the NASDAQ 100 is ready to play catch up with the other US indices, giving us an opportunity to take advantage of what has been a very bullish run, and should continue to be going forward. Keep in mind that the NASDAQ 100 has been a laggard, but that could change.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement