Advertisement

Advertisement

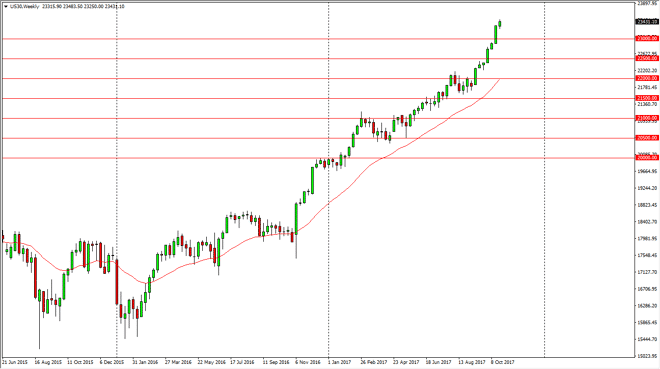

Dow Jones 30 and NASDAQ 100 Forecast for the Week of October 30, 2017, Technical Analysis

Updated: Oct 29, 2017, 08:52 GMT+00:00

Dow Jones 30 The Dow Jones 30 had a slightly positive session during the week, as we continue to extend our gains to the upside. It looks as if the 23,500

Dow Jones 30

The Dow Jones 30 had a slightly positive session during the week, as we continue to extend our gains to the upside. It looks as if the 23,500 level is the next target, but quite frankly this point I think the market has gotten a bit ahead of itself, and quite frankly we need to pull back to build enough momentum and more importantly, the value in the market, to start buying. I think the 23,000 level is supportive, but quite frankly I can envision a pullback to the 22,000 level and still be bullish. This is a market that continues to be overdone, and although bullish, we desperately need to find value. I think we are heading into a very dangerous extension of the market, and that those who are very lax about their stop losses are going to pay the price.

Dow Jones 30 and NASDAQ Index Video 30.10.17

NASDAQ 100

The NASDAQ 100 initially fell during the week but turned around as we bounced from the 6000 handle. We have now broken above the 6200 level which was my target based on an ascending tribal the guy broken to the upside. It looks like we could go higher, but quite frankly we desperately need some type a pullback to offer value in a market that has been so overdone. Given enough time, I think that pullbacks should continue to attract a lot of attention, as the uptrend is very much intact. However, I think that we’re going to see the stock markets pull back a bit, but that only offers value the people are willing to take advantage of. I have no interest in shorting this market until we break significantly below the 5800 level, something that doesn’t look very likely.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement