Advertisement

Advertisement

Dow Jones 30 and NASDAQ 100 Forecast for the Week of September 25, 2017, Technical Analysis

Updated: Sep 24, 2017, 07:41 GMT+00:00

Dow Jones 30 The Dow Jones 30 initially tried to rally during the course of the week but did find a bit of resistance above. Alternately, we ended up

Dow Jones 30

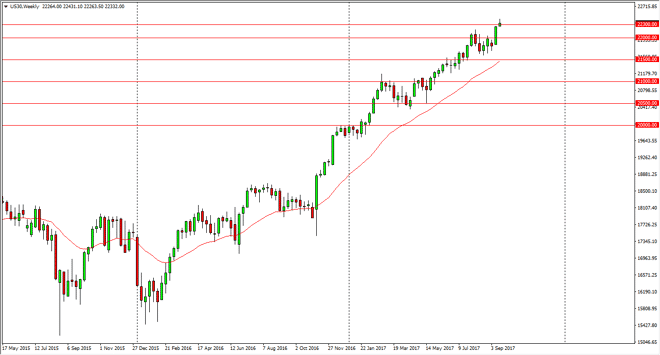

The Dow Jones 30 initially tried to rally during the course of the week but did find a bit of resistance above. Alternately, we ended up forming a bit of a shooting star, but I think that this portends a short-term pullback looking for value, not necessarily any type of significant selling off. If we can break above the top of the candle, then the market should go much higher. I believe that the 22,000 level is supportive, and the uptrend is very reliable so therefore I think it’s only a matter of time before the buyers jump into this market looking at it as value. I have no interest in selling, least not until we break down below the 21,500 level.

Dow Jones 30 and NASDAQ Index Video 25.9.17

NASDAQ 100

The NASDAQ 100 fell significantly during the course of the sessions that made up the last week, but we are still above the uptrend line. We are slowing down our momentum, as the 6000 level has been very resistant. If we can break above there, then I think the market goes much higher. Otherwise, we may get a bit of a pullback. That pullback, and move below the 5800 level kids in this market down the 5700 and then eventually the 5500 level. Given enough time, I think that the buyers will return, but in the meantime, you should think of this as a bullish market, something that you cannot fight as it is so obviously strong. I believe if we break above the 6000 level, we will probably go looking towards the 6100 level in the short term. However, keep in mind that the NASDAQ 100 has been lagging the other US indices over the last several weeks.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement