Advertisement

Advertisement

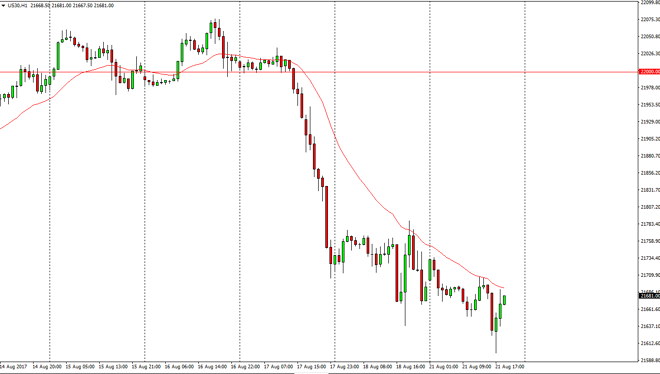

Dow Jones 30 and NASDAQ 100 Price Forecast August 22, 2017, Technical Analysis

Updated: Aug 22, 2017, 05:45 GMT+00:00

Dow Jones 30 The Dow Jones 30 has drifted a bit lower at the open on Monday, but found enough support near the 21,600 level to turn around and bounce.

Dow Jones 30

The Dow Jones 30 has drifted a bit lower at the open on Monday, but found enough support near the 21,600 level to turn around and bounce. Ultimately, I think that the market should then reach towards the 21,750 level, and if we can break above there I think that the market will continue to go much higher, perhaps reaching towards the 22,000 level. Ultimately, I think that the market is bearish, but if we break above the 21,007 are 50 level, the market should then continue to go much higher. If we break down below the 21,500 level, then the market probably goes looking towards the 21,000 level underneath there. Ultimately, this is a very volatile market, and I believe that eventually we will have to make a decision. I suspect that this market is probably best left alone until it shows its true intention.

Dow Jones 30 and NASDAQ Index Video 22.8.17

NASDAQ 100

The NASDAQ 100 fell during the day, breaking below the weekly trend line for a brief moment, but turned around to form a very bullish looking daily candle as we went into the afternoon in America. Ultimately, I think that if we can break above the 5800 level, the market will save the uptrend line, and could send this market towards the 5900-level next. If we break down to a fresh, new low, then that would be a very negative sign. Ultimately, this is a market that I think continues to struggle, but if we can break out to the upside it saves the longer-term uptrend and therefore gives us an opportunity to go higher in the stock markets overall. If we do break down lower, we will probably go looking towards the 5500 level longer term.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement