Advertisement

Advertisement

Dow Jones 30 and NASDAQ 100 Price Forecast December 13, 2013, Technical Analysis

Updated: Dec 13, 2017, 06:14 GMT+00:00

Stock traders around the world will of course be paying attention to the Federal Reserve today, and what its Outlook for interest rate hikes will be for 2018.

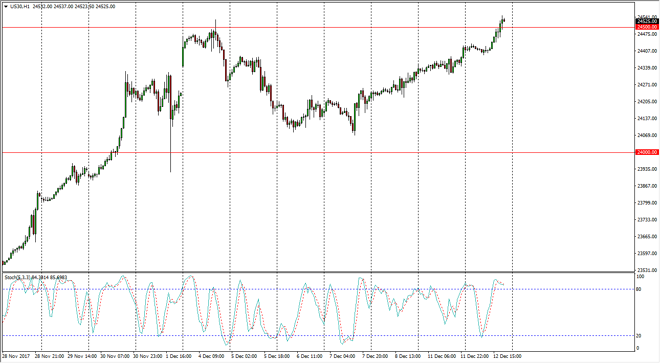

Dow Jones 30

The Dow Jones 30 rallied during the trading session on Tuesday, breaking above the vital 24,500 handle. However, as we approach the interest rate decision out of the United States, it’s likely that the accompanying statement coming from the Federal Reserve will dictate where we go next. If they are more dovish than anticipated, that should send the Dow Jones 30 even higher as it should be negative for the US dollar. Alternately, if they are more hawkish than anticipated, that could be a bit of a drag on this market place. Because of this, it’s probably best to leave this market alone until we get the all-important statement.

Dow Jones 30 and NASDAQ Index Video 13.12.17

NASDAQ 100

The NASDAQ 100 struggle to get above the 6400 level during the day as it is a significant resistance barrier. I believe that the NASDAQ 100 is doing the same thing as the Dow Jones 30 is, simply waiting for the Federal Reserve to tell us which direction it wants to go next. With this in mind, I think pullbacks will eventually offer buying opportunities, but if we were to break down below the 6300 level, that could change everything. We for the daily close to get involved, so therefore I think it’s best to sit on the sidelines and the short-term, because quite frankly, this market could do just about anything after this statement is released. Longer-term, I am bullish, but we could get a significant amount of volatility over the next couple of sessions, so waiting for that daily close to confirm a move is the best way to go.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement