Advertisement

Advertisement

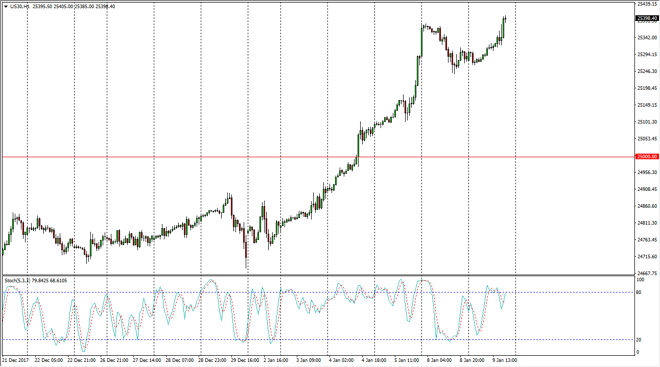

Dow Jones 30 and NASDAQ 100 Price Forecast January 10, 2018, Technical Analysis

Updated: Jan 10, 2018, 04:13 GMT+00:00

The Dow Jones 30 and NASDAQ 100 both had positive sessions, but in varying degrees as the NASDAQ 100 continues to lag a lot of the other indices that I follow. Nonetheless, I bullish of both, and in this article, I will tell you why.

Dow Jones 30

The Dow Jones 30 has made a “higher high” during the day on Tuesday, which always is a bullish sign. We are breaking above the 25,400 level, suggesting that we should go to the 25,500 level after that. I like buying dips, because they offer value in a market that is obviously very bullish. I suspect that the 25,000 level is now going to be the “floor” in the uptrend, and that we are ready to go much higher. The tax bill been signed in the United States helps a lot of the larger companies, which of course influences the Dow Jones 30, as these companies are the pinnacle of American business. I think that the 25,250 level is also going to be support, so short-term pullbacks between here there offer value.

Dow Jones 30 and NASDAQ Index Video 10.01.18

NASDAQ 100

The NASDAQ 100 rallied a bit during the day as well, but did have a short pullback as Americans came back on board. I believe that the market will continue to grind its way to the upside as the 24-hour exponential moving average is offering dynamic support. Ultimately, I think that we go looking towards the 7000 handle, but it’s going to take a long time to get there. In the short term, I would anticipate a move to the 6700 level, and then 6750. I like buying dips, but I recognize that the NASDAQ 100 has been a bit of a laggard when it comes to US indices, not quite performing the way the S&P 500 or the Dow Jones 30 have.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement