Advertisement

Advertisement

Dow Jones 30 and NASDAQ 100 Price Forecast January 11, 2018, Technical Analysis

Updated: Jan 11, 2018, 05:17 GMT+00:00

The Dow Jones 30 and NASDAQ 100 both have been volatile during the trading session, but US stock traders have come back to pick up value in both of these indices. This has been seen around the world in various indices as well, so it looks as if the “risk on” rally continues.

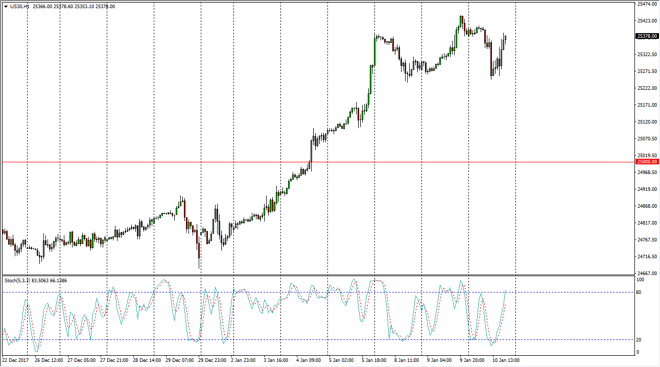

Dow Jones 30

The Dow Jones 30 initially went sideways but then dipped as low as 25,250, before bouncing significantly and breaking above the 25,350 level. Longer-term, I fully anticipate that this market is going to continue to go higher, and that these dips offer a nice opportunity to pick up value in what has been a very strong uptrend. With tax reform recently been past, and of course money managers coming back into the markets after the holidays, it makes sense that there is renewed vigor in this move.

Looking at the last week, you can see that we have been consolidating between 25,250 on the bottom, and 25,450 on the top. I think eventually we break out to the upside, but it may take several attempts. Because of this, I would either be looking to trade range bound trading and smaller positions, or adding slowly and becoming aggressive on a fresh, new high.

Dow Jones 30 and NASDAQ Index Video 11.01.18

NASDAQ 100

The NASDAQ 100 fell a bit more than the Dow Jones 30, and has also rallied a little less stringently than the Dow Jones 30 or the S&P 500. I believe that continues to be the case, and I also recognize that we are in a bullish trend, so while I look at it as a secondary trade currently, it is certainly one that I want to take to the upside and not the down. Buying on dips continues to work here as well.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement