Advertisement

Advertisement

Dow Jones 30 and NASDAQ 100 Price Forecast January 5, 2018, Technical Analysis

Updated: Jan 5, 2018, 08:18 GMT+00:00

The stock markets in America exploded to the upside as it appears that money managers have come back to work, as the holidays are finally over. With today being the jobs number, expect a lot of volatility in the short term, but it’s obvious that the buyers are ready to take out the market to the upside.

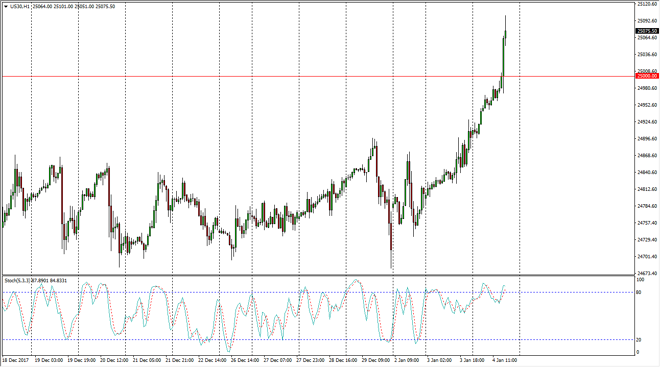

Dow Jones 30

The Dow Jones 30 exploded during the trading session on Thursday, slicing through the 25,000 handle. This is a major milestone, and I believe that it should continue to attract a lot of attention. Pullbacks at this point should be buying opportunities, and quite frankly if we get some type of negativity out of the jobs number, that would be an excellent buying opportunity from what I see. Algorithmic traders continue to be a major lifting force of the market as well, so I don’t have any interest in shorting and I believe that regardless what happens, the buyers are probably going to continue to be very active.

Dow Jones 30 and NASDAQ Index Video 05.01.18

NASDAQ 100

The NASDAQ 100 went sideways with a slightly upward tilt, but I think Reagan above the 6600 level is vital. We will eventually go higher, we are still within the up-trending channel. However, I expect a lot of volatility here, with the 6500 level being the “floor.” In general, I believe that short-term pullbacks offer value the people will take advantage of, but the NASDAQ 100 seems to be very hesitant to explode the way the other indices have. In general, I am positive the NASDAQ 100, but I also recognize that there’s a lot more momentum to take advantage of in both the S&P 500 and the Dow Jones 30. Selling is all but impossible when it comes to the US stock markets.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement