Advertisement

Advertisement

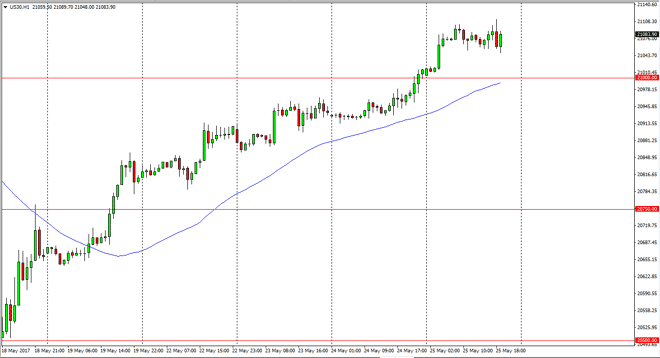

Dow Jones 30 and NASDAQ 100 Price Forecast May 26, 2017, Technical Analysis

Updated: May 26, 2017, 04:06 GMT+00:00

Dow Jones 30 The Dow Jones 30 had a slightly positive session on Thursday, as buyers stepped into the market initially, and then we just went sideways.

Dow Jones 30

The Dow Jones 30 had a slightly positive session on Thursday, as buyers stepped into the market initially, and then we just went sideways. The market is most certainly in a positive uptrend, most US indices are, so I think that buying on the dips is probably the best way to play this market place. I also recognize that the 21,000 level just below should be supportive, along with the 72 hour exponential moving average which I have marked on the chart. This being said, buying the dips offers value that traders can take advantage of and what has been a very strong uptrend. The Dow Jones 30 is moving slower than the other averages though.

Dow Jones 30 and NASDAQ Index Video 26.5.17

NASDAQ 100

The NASDAQ 100 has exploded to the upside as a continues to lead the way for US indices. With this, looks like it’s all but a done deal that we are going to go fishing towards the 5800 level, and I believe that short-term pullbacks will continue to be buying opportunities. This market seems to have a significant amount of support near the 5750 level, so pullbacks all the way to that area should offer plenty of opportunity. Remember, this pair has lead the other US indices higher overall, and I think that is going to continue to be the case. The fact that this pair continues to show strength is a very good sign for US stock indices overall, so therefore I feel that the entire sector is going to be a “buy on the dips” situation. The market continues to lead the way for not only the United States, but the rest of the world. In fact, I am very bullish of stock indices everywhere.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement