Advertisement

Advertisement

Dow Jones 30 and NASDAQ 100 Price Forecast November 17, 2017, Technical Analysis

Updated: Nov 17, 2017, 05:01 GMT+00:00

Dow Jones 30 The Dow Jones 30 rallied during the trading session on Thursday, as US stock markets took off. We are approaching the 23,500 level, and that

Dow Jones 30

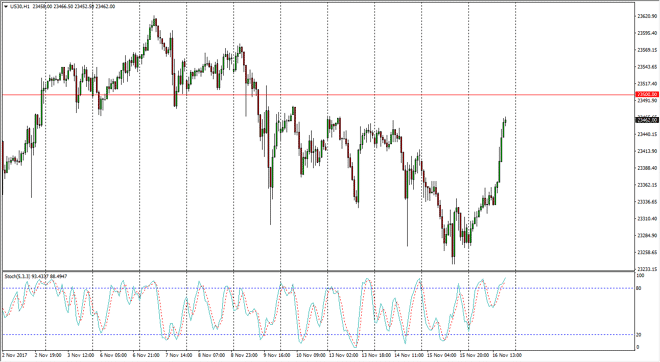

The Dow Jones 30 rallied during the trading session on Thursday, as US stock markets took off. We are approaching the 23,500 level, and that is an area that should be somewhat resistive. It was reported in the past, but we have broken below there. With this type of strong rally, I suspect that we will have buyers come in on dips, and I do think that the market is getting a bit overbought. When I look at the stochastic oscillator, we don’t have a cross yet, but I feel it’s only a matter of time before we should be a to find some type of value. A break above the 23,500 level would be a strong sign of strength. Overall, I am a buyer, but I recognize that we need to find enough value to get people excited about buying.

Dow Jones 31 and NASDAQ Index Video 17.11.17

NASDAQ 100

The NASDAQ 100 has absolutely checked out as the buyers have sliced through the 6300 level like it wasn’t even there. However, the stochastic oscillator looks as if it is ready to cross over in the overbought region on the hourly chart, so I think we could get a bit of a pullback. The 6300 level should be support though, as it is previous fair value. I think that pullbacks will offer value the people are willing to take advantage of, as we then go looking towards the 6400 level, and then my longer-term target of 6500. I have no interest in shorting this market, least not until we would be able to break down below the 6200 level on a daily close, something that looks almost impossible at this point. That’s not to say it won’t be volatile, but certainly it looks likely that there is plenty of buying pressure.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement