Advertisement

Advertisement

Dow Jones 30 and NASDAQ 100 Price Forecast November 21, 2017, Technical Analysis

Updated: Nov 21, 2017, 05:05 GMT+00:00

Dow Jones 30 The Dow Jones 30 drifted a bit lower during the trading session on Monday, but found enough support near the 23,250 level to turn around and

Dow Jones 30

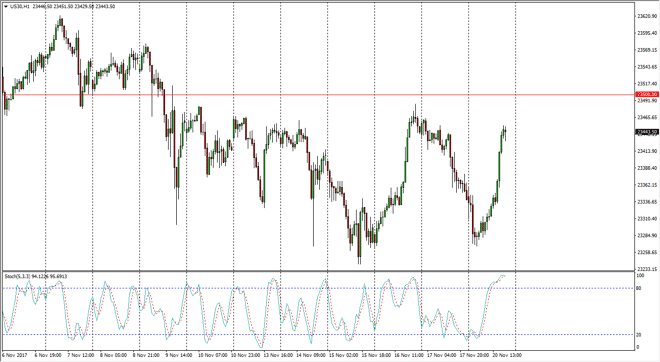

The Dow Jones 30 drifted a bit lower during the trading session on Monday, but found enough support near the 23,250 level to turn around and bounce significantly to reach towards the 23,500 level. I believe that that market continues to be massively resistive in that area, so I think that it’s going to take a significant amount of momentum to finally break out above there. The stochastic oscillator crossing in the overbought area tells me that we will more than likely fail to break above there, and there I think that the sellers will get involved yet again. We are overbought, and heading into a very long weekend, and therefore a lot of people would be very hesitant to put a lot of money to work into the market.

Dow Jones 31 and NASDAQ Index Video 21.11.17

NASDAQ 100

The NASDAQ 100 broke above the 6300 level again, and then pulled back to test it for support. We did find it there, so it looks as if the NASDAQ 100 may try to lead the rest of the US indices higher. However, I think that it is probably going to be very choppy, and although I don’t want to short this market, I am a bit cautious about buying right now. If we can break above the 6350 handle, then I think the market goes to the 6400 level after that. If we do break down, I anticipate that there is a lot of support near the 6225-level underneath. The NASDAQ 100 of course is very sensitive to rest sentiment, which right now might be a bit stretched, so pullbacks are probably necessary for people to find enough value to get involved. Noise will continue to be a major factor in this market.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement