Advertisement

Advertisement

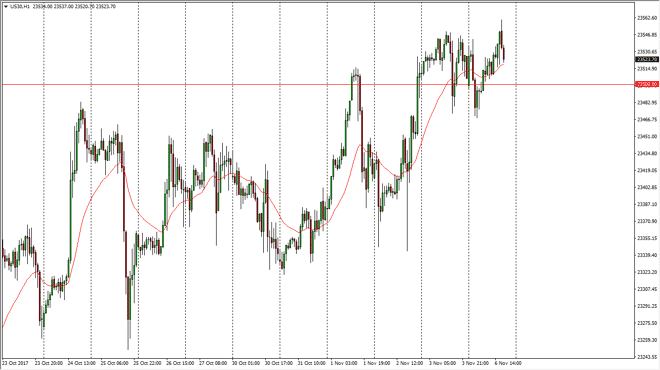

Dow Jones 30 and NASDAQ 100 Price Forecast November 7, 2017, Technical Analysis

Updated: Nov 7, 2017, 08:26 GMT+00:00

Dow Jones 30 The Dow Jones 30 fell initially on Monday, but then broke higher, and at one point even made a fresh, new high. The market looks likely to

Dow Jones 30

The Dow Jones 30 fell initially on Monday, but then broke higher, and at one point even made a fresh, new high. The market looks likely to continue to go higher, as the 24-hour exponential moving average has been offering dynamic support over the last several hours. It is also turning to the upside, and it also looks likely that the €23,400 level underneath is going to offer a bit of a “floor.” Longer-term, I don’t see any reason the Dow Jones 30 won’t try to go to the 24,000 level, but we are probably going to need to pull back and buy the dips as they offer value, and a bit of a momentum-building exercise so that we can finally go higher.

Dow Jones 31 and NASDAQ Index Video 07.11.17

NASDAQ 100

The NASDAQ 100 has broken above the 6300 level and now looks likely to find this area as somewhat supportive. The 24-hour exponential moving average is far below, but it is turning towards the upside, and it looks likely that we will then go to the 6400 level above. Overall, this is a market that should continue to be healthy, as we have been in a nice uptrend for some time, perhaps reaching towards the 6500 level over the longer term. I think the 6200 level will offer a bit of a “floor”, but I think that the market would be hard-pressed to go down to that level. I think that the overall attitude of the market continues to be a bullish one, as algorithmic traders have flooded the market with buy orders once we drop below 1% at any time. We should continue to see this phenomenon, but a breakdown below the 6200 level would be very negative indeed.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement