Advertisement

Advertisement

Dow Jones 30 and NASDAQ 100 Price Forecast November 9, 2017, Technical Analysis

Updated: Nov 9, 2017, 08:51 GMT+00:00

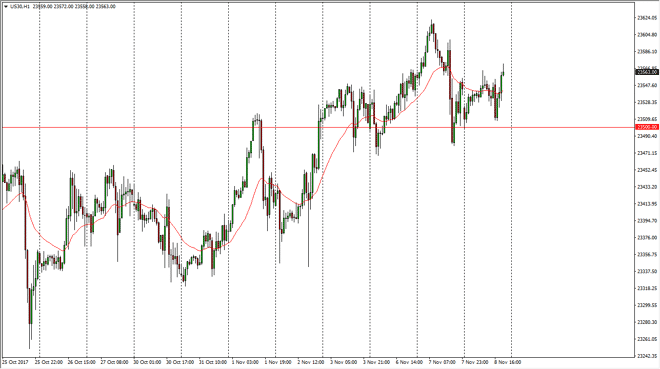

Dow Jones 30

The Dow Jones 30 initially was volatile during the trading session on Wednesday but found the 23,500 level to be supportive enough to turn the market around and break out. I think the market is probably going to go looking towards the highs again, meaning that we should go looking towards the 23,600 level. I think pullbacks should continue to find support at the 23,500-level underneath, and that’s likely to be a bit of a “floor” for the short-term traders. I think that given enough time, the market should continue to attract money as pullbacks represent value in what is an obvious uptrend longer term. I believe that we will be looking at 25,000 sometime next year, but obviously, it’s going to take a lot of work to get there.

Dow Jones 31 and NASDAQ Index Video 09.11.17

NASDAQ 100

The NASDAQ 100 has broken out to a fresh, new high, breaking above the 6300 level. The NASDAQ 100 should continue to be very bullish, it’s likely that the buyers will be willing to pick up dips as value. I think the 6300 level at this point is the “floor” of the market, and that it’s only a matter of time before we go much higher. Longer-term, I believe that the 6500 level above is the target, but I also recognize that there will be quite a bit of volatility. The NASDAQ 100, of course, is volatile by its very nature, as it is technology driven. However, we are in a nice uptrend and it looks as if the 24-hour exponential moving average is going to continue to offer support, and I am a buyer going forward on these small dips that will occur. Currently, I have no interest in shorting at all.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement