Advertisement

Advertisement

Dow Jones 30 and NASDAQ 100 Price Forecast September 25, 2017, Technical Analysis

Updated: Sep 23, 2017, 07:07 GMT+00:00

Dow Jones 30 The Dow Jones 30 as you can see initially fell during the session on Friday but found enough support at the psychologically and structurally

Dow Jones 30

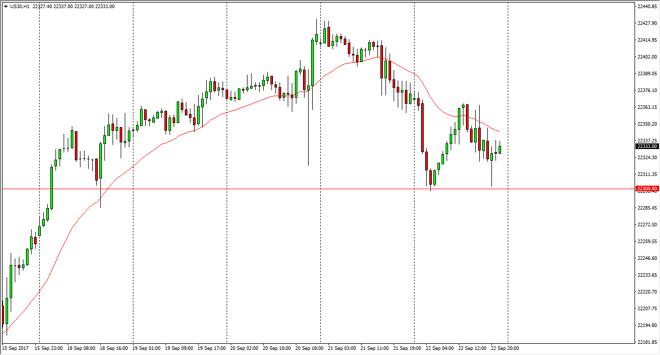

The Dow Jones 30 as you can see initially fell during the session on Friday but found enough support at the psychologically and structurally important 22,300 level to bounce but turned around and felt to test that level again. When it up forming a bit of a hammer on the hourly chart, so I think if we can break above the 22,375 level, we will have finished a “W pattern”, one of the most bullish patterns that I trade. If we break above there, the market should then go to the 22,440 level. Alternately, if we break down below the 22,300 level, that could send this market looking for the 22,200 level. Overall though, we are in an uptrend, so it makes sense that the Dow Jones 30 should continue to look very bullish.

Dow Jones 30 and NASDAQ Index Video 25.9.17

NASDAQ 100

The NASDAQ 100 had a very similar day, falling down towards the 4900 level. That’s an area that has been important in the past, and it now has offered support in this market. I believe that we will eventually go higher, but is going to be choppy. If we can break above the 5950 level, then I think we go back towards the 6000 handle, and perhaps break above there to go to much higher levels. This pullback has been interesting, but I think it has been more or less a momentum building exercise than anything else. Stock markets overall continue to rally, and although the NASDAQ 100 will probably lag behind other indices in America, I think it is still bullish. I have no interest in shorting, least not until we were to break down below the 5900 level on a daily close. Right now, that doesn’t look very likely.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement