Advertisement

Advertisement

Dow Jones 30 and NASDAQ 100 Price forecast for the week of January 2, 2018, Technical Analysis

Updated: Dec 30, 2017, 07:09 GMT+00:00

The US stock indices rally during the week, but in thin and illiquid trading, we could not hang on to the gains. I think we are getting a bit overextended, so short-term pullback is possible. It will also be very hesitant to move drastically with the jobs number coming.

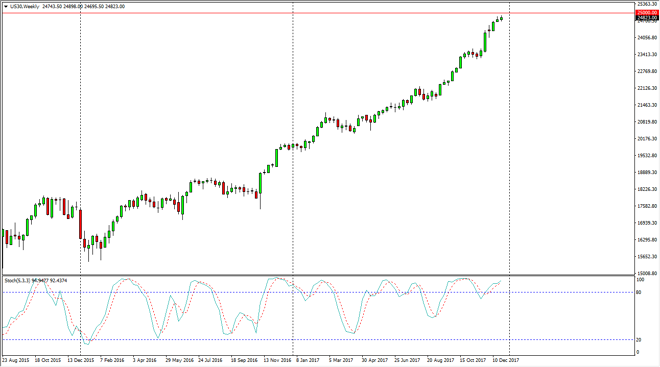

Dow Jones 30

The Dow Jones 30 rallied a bit during the week, but you can see that the 25,000 level above is a psychological resistance barrier, and we could not break above it. The weekly candle is a bit of a shooting star, but with this then trading, I don’t pay much attention to the market action as you have to look at the totality of how things have gone. We are bit overextended at based upon the stochastic oscillator, and we crossed as well, which of course means we will probably get a selling opportunity. However, I prefer to go long as the trend is in that direction, so the 23,500-level underneath should be a massive buying opportunity.

Dow Jones 30 and NASDAQ Index Video 02.01.18

NASDAQ 100

The NASDAQ 100 was also very positive for the year, but we pulled back a bit during this week, reaching towards the 6400 level. The shooting star from the previous week suggested that we were to pull back, but I think there is a certain amount of support in the 6400 level, and we also have an uptrend going on in the form of the channel, so I believe it’s only a matter of time before the buyers get involved. I like buying the NASDAQ 100, but we need to see it on short-term charts such as a daily timeframe, as it can fine tune our move. Given enough time, I think we break above the 6500 level.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement