Advertisement

Advertisement

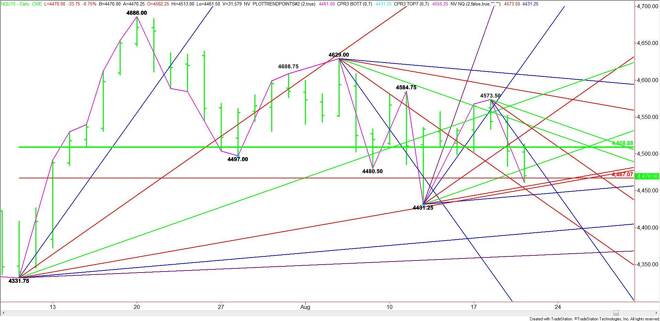

E-mini NASDAQ-100 Index (NQ) Futures Technical Analysis – August 20, 2015 Forecast

By:

September E-mini NASDAQ-100 Index futures are trading lower shortly before the cash market opening. The index is currently straddling a major Fibonacci

September E-mini NASDAQ-100 Index futures are trading lower shortly before the cash market opening. The index is currently straddling a major Fibonacci level at 4467.00. Trader reaction to this level will determine the direction of the market during the regular session.

The first major support under 4467.00 is a short-term/long-term Gann angle cluster at 4455.25 and 4451.75. The next target under this area is an uptrending angle at 4443.25. This is the last major support before the 4431.25 main bottom.

Taking out 4431.25 will signal a resumption of the downtrend. The daily chart opens up under this bottom with the next major targets coming in at 4391.75 and 4361.75. The latter is the last major support before the 4331.75 main bottom.

Holding 4467.00 will signal the presence of buyers. Overtaking the uptrending angle at 4671.25 will signal that the buying is getting stronger. A sustained move over this angle could trigger a move into the resistance cluster at 4509.00 to 4509.50.

The angle at 4509.50 is a potential trigger point for a further rally into the next potential resistance cluster at 4541.00 to 4541.50.

The angle at 4541.50 is another trigger point for an upside breakout with 4557.50 the next target, followed by the main top at 4573.50.

Watch and read the price action and order flow at 4467.00. This will tell us whether the bulls or bears are in control today.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement