Advertisement

Advertisement

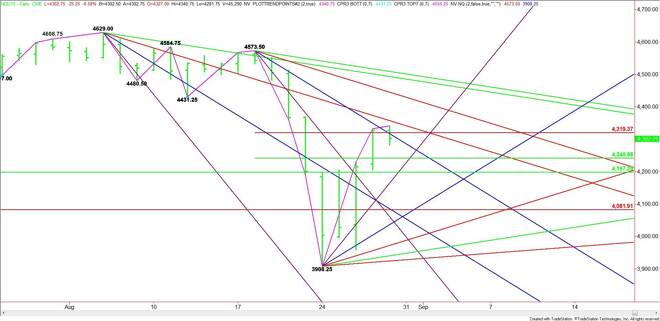

E-mini NASDAQ-100 Index (NQ) Futures Technical Analysis – August 28, 2015 Forecast

By:

September E-mini NASDAQ-100 Index futures are called lower shortly before the cash market opening. There was some follow-through to the upside after

September E-mini NASDAQ-100 Index futures are called lower shortly before the cash market opening. There was some follow-through to the upside after yesterday’s strong close, but buyers failed to hold on to the early gains, putting the index back inside a short-term retracement zone. Trader reaction to this zone will determine the direction of the market today.

The main trend is down according to the daily swing chart. The short-term range is 4573.50 to 3908.25. Its retracement zone is 4240.75 to 4319.50. Earlier in the session, the index tried to breakout over the upper or Fibonacci level at 4319.50, but the move failed.

Based on the current price at 4302.75, the first resistance is a downtrending angle at 4317.50. This is followed by the Fib level at 4319.50 and another downtrending angle at 4357.00.

The angle at 4357.00 is also a trigger point for an upside breakout into the next downtrending angle at 4445.50. This is followed by a pair of angles at 4493.00 and 4509.50.

If sellers come in to defend 4317.50 to 4319.50 then look for the break to extend into the short-term 50% level at 4240.75. Taking out this level could trigger further weakness into a major 50% level at 4197.25. This is followed by a steep uptrending angle at 4164.25.

Breaking the angle at 4164.25 could trigger a steep sell-off into a major Fib level at 4082.00.

Based on the early price action, the direction of the market today will be determined by trader reaction to 4319.50. Look for a bullish tone to develop on a sustained move over 4319.50 and a bearish tone to develop on a sustained move under this price.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement