Advertisement

Advertisement

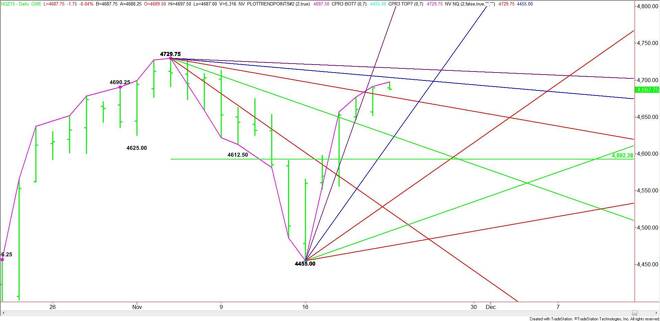

E-mini NASDAQ-100 Index (NQ) Futures Technical Analysis – November 23, 2015 Forecast

By:

December E-mini NASDAQ-100 Index futures inched higher early in the pre-market session before pulling back to unchanged. Although upside momentum appears

December E-mini NASDAQ-100 Index futures inched higher early in the pre-market session before pulling back to unchanged. Although upside momentum appears to be easing, the index is still within striking distance of the November 4 main top. Investors seem to have accepted a December rate hike by the Fed. There is some uncertainty building over the timing of future rate hikes and this is helping to underpin the market.

Based on Friday’s close at 4689.50, the first upside objective is a downtrending angle at 4703.75. This is followed closely by another downtrending angle at 4716.75. This is the last potential resistance angle before the 4729.75 main top. A trade through the main top will signal a resumption of the uptrend.

The first downside target is a downtrending angle at 4677.75. The daily chart opens up to the downside on a sustained move under this angle with the next major target coming in at 4615.00.

Today’s session begins with the index up 5 days from the 4455.00 main bottom. This give it 2 to 5 days before it enters the window of time for a potential rally-killing closing price reversal top. However, investors should still watch for this pattern especially if a rally over 4729.75 fails to attract fresh money.

Volume is expected to be light this week because of the U.S. bank holiday on Thursday. Therefore, you have to watch for periodic episodes of increased volatility due to the thin trading conditions. Look for a bullish bias to develop on a sustained move over 4703.75 and a bearish bias on a sustained move under 4677.75.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement