Advertisement

Advertisement

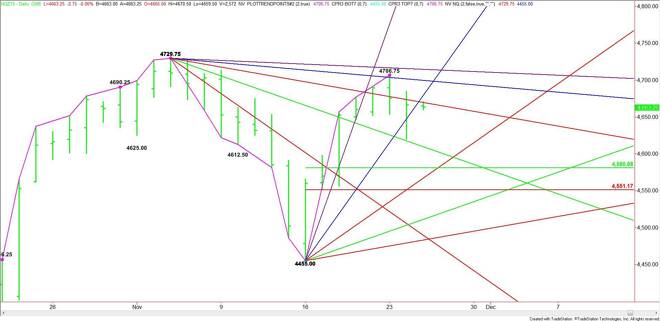

E-mini NASDAQ-100 Index (NQ) Futures Technical Analysis – November 25, 2015 Forecast

By:

December E-mini NASDAQ-100 Index futures are trading flat early in today’s session. Yesterday, the index sold-off sharply after confirming Monday’s

December E-mini NASDAQ-100 Index futures are trading flat early in today’s session. Yesterday, the index sold-off sharply after confirming Monday’s potentially bearish closing price reversal top.

The main trend is up according to the daily swing chart. However, momentum may have shifted to the downside with the formation of the closing price reversal top on November 23. If enough selling pressure is present then we could see a 2 to 3 day retracement of the recent rally from 4455.00 to 4706.75.

Based on Tuesday’s close at 4666.00, the key level to watch is a downtrending angle at 4669.75.

A sustained move over 4669.75 will indicate the presence of buyers. Overcoming the steep uptrending angle at 4679.00 will shift momentum back to the upside. This could trigger a move into the next downtrending angle at 4699.75. This is followed by the closing price reversal top at 4706.75.

Taking out 4706.75 will negate the closing price reversal top. This could create enough upside momentum to challenge the next downtrending angle at 4714.75. This is the last potential resistance angle before the 4729.75 main top.

A sustained move under 4669.75 will signal the presence of sellers. The daily chart indicates there is plenty of room to the downside with the nearest target a downtrending angle at 4609.75. This angle essentially stopped the break on Tuesday.

The main range is 4455.00 to 4706.75. If sellers continue to hit the market under 4609.75 then look for a test of its retracement zone at 4580.75 to 4551.00 over the near-term.

Watch the price action and read the order flow at 4669.75 today. Trader reaction to this angle will tell us whether the bulls or the bears are in control.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement