Advertisement

Advertisement

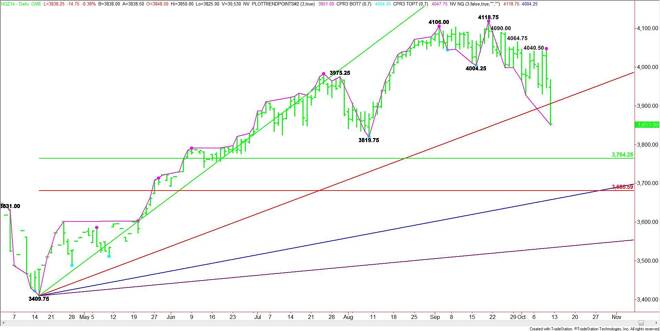

E-mini NASDAQ-100 Index (NQ) Futures Technical Analysis – October 13, 2014 Forecast

By:

December E-mini NASDAQ-100 Index futures closed on the weak side of a long-term uptrending angle on Friday, setting up the market for further downside

December E-mini NASDAQ-100 Index futures closed on the weak side of a long-term uptrending angle on Friday, setting up the market for further downside action on Monday. This angle comes in at 3905.75. Regaining this angle will indicate short-covering.

The daily chart opens up to the downside today with the first target the August 8 bottom at 3819.75.

This is followed by the major retracement zone at 3764.25 to 3680.50. Additional support is an uptrending angle at 3657.75.

Although the main trend is down on the daily chart, traders should watch for a technical bounce on the first test of the 50% level at 3764.25. If this price fails then look for a test of the Fib level at 3680.50.

On the upside, shorts may cover aggressively if 3905.75 is overcome with conviction.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement