Advertisement

Advertisement

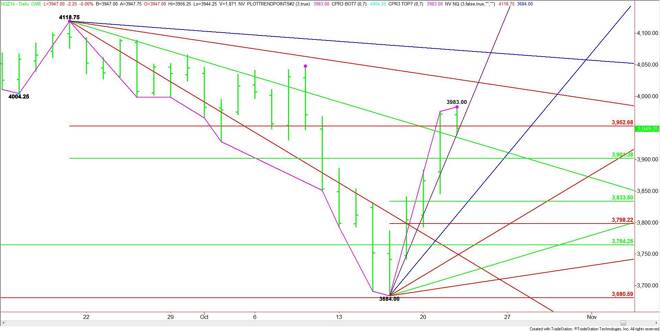

E-mini NASDAQ-100 Index (NQ) Futures Technical Analysis – October 23, 2014 Forecast

By:

The rally by the December E-mini NASDAQ-100 Index futures market failed at 3983.00, forming a potentially bearish closing price reversal top. A trade

The rally by the December E-mini NASDAQ-100 Index futures market failed at 3983.00, forming a potentially bearish closing price reversal top. A trade through 3939.50 will confirm the chart pattern. The new range is 3684.00 to 3983.00. This makes its retracement zone at 3833.50 to 3798.25 the primary downside target.

The key uptrending angle to watch today is at 4004.00. This angle provided support for four days. Yesterday’s close at 3949.25 was below this angle, putting the index in a bearish position on the opening. The NASDAQ will have to regain this angle to give it the same momentum it had for the past four days.

Besides the close below the angle, the index also finished below a Fibonacci level at 3952.75. This is another sign of developing weakness.

The key to sustaining the weakness today will be the follow-through break through 3939.50. If this doesn’t occur then don’t be surprised by a reversal back to the upside. Taking out 3983.00 will negate the potentially bearish chart pattern and could trigger an acceleration into a resistance angle at 4022.75 then 4070.75.

If the chart pattern is confirmed then look for sellers to go after a long-term downtrending angle at 3926.75. The daily chart opens up under this angle with the 50% level at 3901.25 the next target.

Watch for an acceleration to the downside if 3901.25 is taken out with conviction since the nearest support angle doesn’t come in until 3844.00. This is followed by the primary 50% target at 3833.50.

The tone of the market today will be determined by trader reaction to 3939.50. Holding this level could trigger a reversal to the upside, but taking it out with conviction will likely lead to the start of a short-term correction.

If selling weakness, make sure the move takes place with better-than-average volume.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement