Advertisement

Advertisement

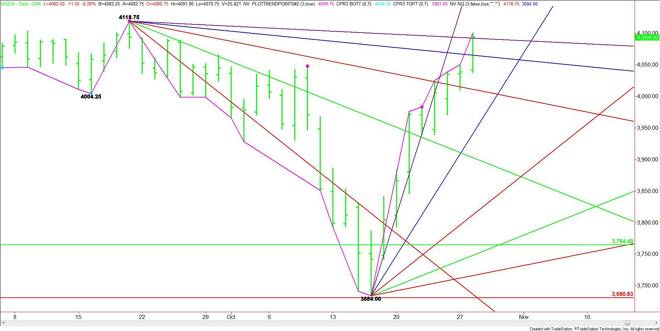

E-mini NASDAQ-100 Index (NQ) Futures Technical Analysis – October 29, 2014 Forecast

By:

December E-mini NASDAQ-100 Index futures closed on its high at 4094.00, putting the index in a position to continue its eight day rally today. Despite the

December E-mini NASDAQ-100 Index futures closed on its high at 4094.00, putting the index in a position to continue its eight day rally today. Despite the bullish close, the index is in the window of time to produce a potentially bearish closing price reversal top so long investors should have an exit strategy and aggressive counter-trend traders should start to watch for topping signals on the intraday charts.

No one is saying bailout at current price levels, just be prepared for a top. If the market is still bullish then the upside will take care of itself. It’s the downside that tends to be unpredictable.

The first angle to watch today is at 4090.75. Yesterday’s close was over this level so watch for a steady to better opening. This is the last angle before the contract high at 4118.75. The nearest resistance over this level is 4150.00.

A failure to hold 4118.75 will indicate early profit-taking. However, a trade through the next angle at 4062.75 will indicate real selling pressure. The market opens up under this level with 4006.75 the next possible target over the near-term.

Look for increased volatility following the release of the Fed announcement at 2:00 pm. ET. Theoretically, a dovish statement should be bullish for stocks, but no one is certain how much of this has already been baked into the market. Because of the strong eight session rally, this could turn out to be a “buy the rumor, sell the fact” situation.

Technically, the market is in the window of time for a closing price reversal top so don’t be surprised if the market rallies early then closes lower at the end of the day. The tone of the market today is likely to be determined by trader reaction to 4090.75.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement