Advertisement

Advertisement

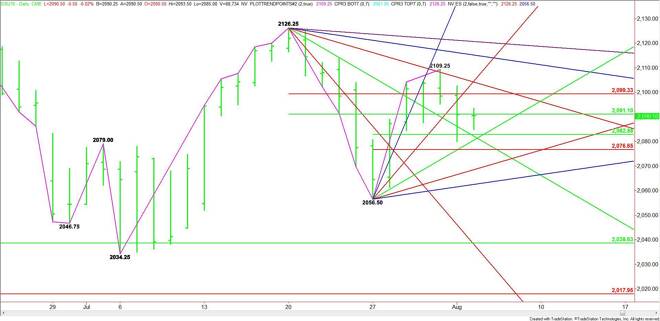

E-mini S&P 500 Index (ES) Futures Technical Analysis – August 4, 2015 Forecast

By:

September E-mini S&P 500 Index futures are trading flat shortly ahead of the cash market opening. The main trend is up according to the daily swing

September E-mini S&P 500 Index futures are trading flat shortly ahead of the cash market opening. The main trend is up according to the daily swing chart, but momentum appears to be shifting to the downside.

The main range is 2126.25 to 2056.50. The retracement zone is 2091.25 to 2099.50. The market has straddled this zone over the past five days.

The short-term range is 2056.50 to 2109.25. Its retracement zone is 2082.75 to 2076.50. This zone was tested on Monday.

With the U.S. Non-Farm Payrolls report coming up on Friday, the index could trade sideways between the retracement zones over the next few days. This could help produce a choppy, two-sided trade.

On the downside today, a price cluster comes in at 2082.75, 2082.25 and 2080.25. Since the trend is up, there may be a technical bounce on the first test of this area. If sellers prevail and the market breaks under 2080.25 then look for the selling to extend into the Fibonacci level at 2076.50. The daily chart opens up to the downside with 2068.50 the next potential target.

A sustained move over 2091.25 will signal the presence of buyers. This could trigger an acceleration to the upside with 2099.50 the next target, followed by a downtrending angle and an uptrending angle at 2104.25 and 2104.50 respectively. The daily chart opens up to the upside over this area with potential targets at 2109.25 and 2115.25.

The direction of the market today is likely to be determined by trader reaction to the 50% level at 2091.25.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement