Advertisement

Advertisement

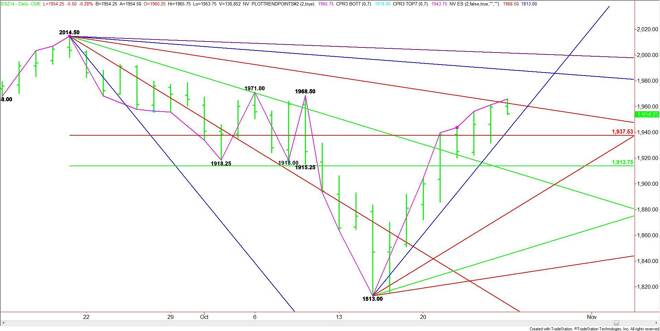

E-mini S&P 500 Index (ES) Futures Technical Analysis – October 27, 2014, Forecast

By:

December E-mini S&P 500 Index futures finished the week by challenging a pair of main tops at 1968.50 and 1971.00. These two levels are still within

December E-mini S&P 500 Index futures finished the week by challenging a pair of main tops at 1968.50 and 1971.00. These two levels are still within striking distance. A trade through 1968.50 will turn the main trend to up on the daily chart.

The first resistance today is a downtrending angle from the 2014.50 top at 1962.50. Taking out then holding above this angle will likely lead to tests of 1968.50 and 1971.00.

If 1971.00 is taken out with conviction then look for the index to make a run at 1988.50. This is followed by a downtrending angle at 2001.50. This is the last angle before the contract high at 2014.50.

On the downside, the first potential support is an uptrending angle at 1941.00. This is followed by a Fibonacci level at 1937.50. The market opens up under this level with 1913.75 the next potential target.

Today is the eighth day up from the 1813.00 bottom which puts the index in the window of time for a potentially bearish closing price reversal top. Traders should watch the intraday charts closely for a higher-high, lower-close chart pattern.

The tone of the market will be determined by trader reaction to 1962.50. This angle is likely to act like a pivot today.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement