Advertisement

Advertisement

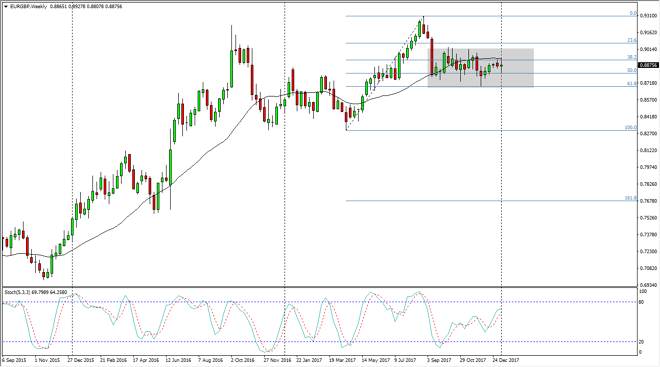

EUR/GBP forecast for the week of January 15, 2018, Technical Analysis

Updated: Jan 13, 2018, 03:02 GMT+00:00

The EUR/GBP pair continues to drift sideways and listlessly, in a larger consolidation region. The market seems to have plenty of support at the 61.8% Fibonacci retracement level, just as the resistance formed at the 0.90 level. Overall, this is a market that favor short-term trading.

The EUR/GBP pair has gone back and forth, showing signs of consolidation over the last several months. This makes a lot of sense, as we are currently in the middle of negotiations between the European Union and the United Kingdom, and that of course suggests that we are going to continue this until we get some type of conclusion to those negotiations. Longer-term, we have been in an uptrend when it comes to this market, and that being the case it’s likely that we will eventually break out to the upside. I think a break above the 0.90 level on a daily close would be a reason to go long on a longer-term aspect, but in the meantime, I think it makes more sense to go back and forth on shorter-term charts to take advantage of obvious levels in this market.

Longer-term, and makes sense that we go higher not only due to the overall trend, it’s likely that traders will feel much more comfortable investing in the European Union, as there is more stability there and a lot of less unknowns. It’s not that I think the United Kingdom is going to fall apart, I just believe that we will more than likely see traders be interested in this market to the upside as there will be a period of the United Kingdom trying to prove itself to investment. If we broke down below the 61.8% Fibonacci retracement level on the weekly chart, then I think we could start selling. Until then, I favor the upside.

EUR/GBP Video 15.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement