Advertisement

Advertisement

EUR/GBP Price Forecast February 13, 2018, Technical Analysis

Updated: Feb 13, 2018, 04:36 GMT+00:00

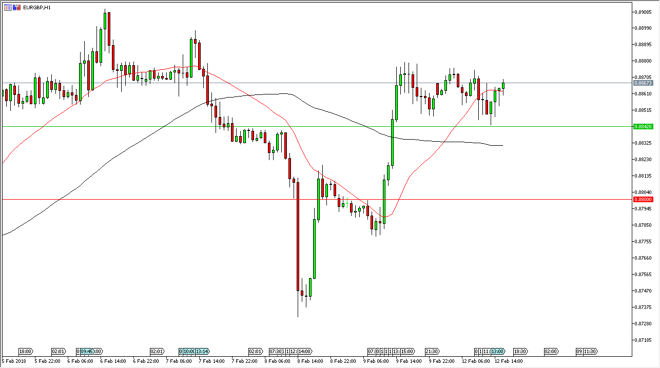

The EUR/GBP pair continues to grind sideways, with the 0.8840 level offering support, while the 0.8885 level is offering resistance. This is typical, as the 2 economies are so intertwined, and of course we have the negotiations between the United Kingdom and the European Union going on that will have a massive effect on where this pair goes, so headline risk is most certainly there.

The EUR/GBP pair continues to grind sideways, as we try to figure out how the negotiations are going to end up. The sideways action is indicative of fear, because the market doesn’t want to jump in with both feet and bet on one of the currencies. I think that’s going to be the case going forward, and right now we are essentially stuck in a small range, but for those of you trade sideways markets, you’re going to love this currency pair. By employing a trading strategy that relies on consolidation, you should do quite well.

If we do break down below the support, I think there’s even more support at the 0.88 level. Keep in mind that the occasional headline could crossed the wires that causes the market to move drastically, but in general we have been seeing a lot of grinding and sideways action, something that I would anticipate seeing going forward. Ultimately, I believe that the uptrend continues, but there are a lot of questions between now and then, and of course concerned.

I believe that this market will eventually go looking towards 0.90 above, which has been resistance in the longer-term consolidation. If we can clear that area, then we will go towards the 0.93 level after that, which was the most recent highs on the longer-term charts. Remember, the pip value is almost twice what other pairs are, so quite frankly you don’t need the market to move as far.

EUR/GBP Video 13.02.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement