Advertisement

Advertisement

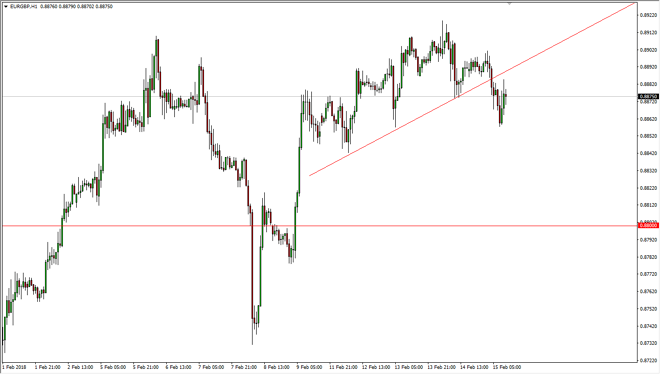

EUR/GBP Price Forecast February 16, 2018, Technical Analysis

Updated: Feb 16, 2018, 05:21 GMT+00:00

The EUR/GBP pair has been choppy during the trading on Thursday, after breaking down below an uptrend line. This tells me that the market is more than likely going to continue to drift a little bit lower, as we have broken through a short-term uptrend line. However, there is a significant amount of support just below, so I think the downside is somewhat limited.

The EUR/GBP pair has broken down a bit during the trading session on Thursday, slicing through an uptrend line. It looks as if the market is ready to go down to the 0.88 level if this keeps up, but quite frankly I think there’s plenty of support in that area. Ultimately, I think that the market will probably find buyers down there, and therefore could be a buying opportunity. I think that the overall consolidation and choppiness should continue, mainly because of the negotiations between the European Union and the United Kingdom the continue. Headlines can cross the wires that any time to move the market in either direction.

Even if we break down below the 0.88 level, it appears that there is plenty of support underneath that the 0.8750 level as well, an area that should be massively important. I don’t expect any type of major breakout, at least not until the negotiations are done. Ultimately, I do believe in the uptrend, but I also recognize that there will be a lot of concern and noise between now and when we get the larger term move. Longer-term, I would anticipate that the 0.93 level above is important as it is the recent all-time highs, and I think we will revisit that level later this year. However, it is going to be very noisy in the meantime, so be cautious. I think that this pullback should offer a short-term buying opportunity once it’s all said and done.

EUR/GBP Video 16.02.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement