Advertisement

Advertisement

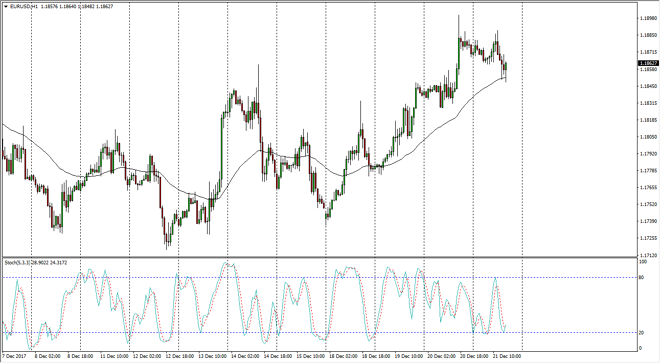

EUR/USD Price Forecast December 22, 2017, Technical Analysis

Updated: Dec 22, 2017, 05:44 GMT+00:00

The EUR/USD pair pulled back slightly during the trading session on Thursday, reaching towards the 1.1850 level. That’s an area that was resistive in the past, so it should now offer support. In general, I am paying quite a bit of attention to this pair, because we are forming a major bullish signal on the longer-term charts.

The EUR/USD pair pulled back slightly during the trading session on Thursday, reaching down to the 1.1850 level. That’s an area that has been resistance in the past, and now is starting act as support. When I look at the longer-term charts, specifically the weekly timeframe, I recognize that we have a nice bullish flag, and that could reach towards the 1.32 level longer term. Because of this, I have an upward bias when it comes to the EUR/USD pair, and I don’t have any interest in shorting. That would change if we can break down below the 1.17 level underneath, but quite frankly I don’t think that’s going to happen.

A break above the 1.20 level is significant, but even more importantly is a break above the 1.21 handle, which is the most recent high, and with signify that we are ready to go much higher. I believe that even though the United States has passed significant tax reform, it looks increasingly likely that the pair should continue to go higher, perhaps in more of a “risk on” move. Volatility will remain due to the time year, but I think that the smart money is starting to come in and put some positions on ahead of the new year. Typically, we will see volatility pick up after New Year’s Day, and that could be when we make the significant push to the upside.

EURUSD analysis Video 22.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement