Advertisement

Advertisement

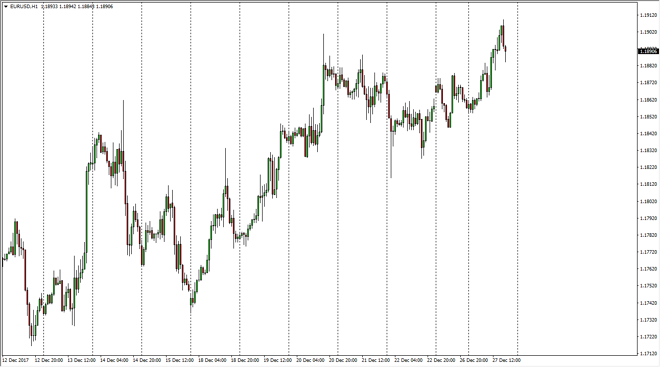

EUR/USD Price Forecast December 28, 2017, Technical Analysis

Updated: Dec 28, 2017, 05:00 GMT+00:00

The EUR/USD pair has rallied a bit during the trading session on Wednesday, but liquidity is a bit thin, so I don’t read too much into it although longer-term this chart certainly looks bullish.

The EUR/USD pair rallied significantly during the trading session on Wednesday, testing the 1.1910 level. I think that if we can break out above the 1.1925 level, the market should go much higher, as it would break the top of a weekly bullish flag. I think we are going to see that relatively soon, but right now liquidity is going to be a bit of an issue as traders are probably away from their desk.

I believe that the 1.18 level underneath will offer significant support, just as the 1.17 level underneath well. Longer-term, I believe that breaking above the top of the bullish flashes in this market looking for the 1.32 handle, which obviously would be a longer-term target, and nothing that we would see anytime soon. It appears that the US dollar in general is starting to soften, but as the liquidity is thin around the Forex world, it’s difficult to read too much into the short-term movement. What will matter is when traders come back after New Year’s Day, and how they start piling into the marketplace. As things stand right now, I am bullish of the EUR/USD pair, but I recognize that we could get sudden pullbacks occasionally as it certainly continues to favor the upside in general. I don’t have any interest in shorting this market, least not until we break down below the 1.17 handle, and at that point I think we would go looking towards the 1.15 level underneath which should be even more supportive. Expect noise, but I think a decidedly positive slant in this market exists.

EURUSD analysis Video 28.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement