Advertisement

Advertisement

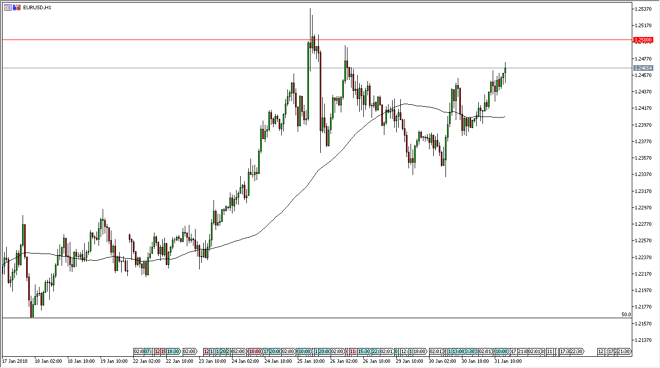

EUR/USD Price Forecast February 1, 2018, Technical Analysis

Updated: Feb 1, 2018, 05:34 GMT+00:00

The EUR/USD pair rallied a bit during the trading session again on Wednesday, showing signs of life. The 1.25 level above seems to be a target, and of course there is a general negativity to the greenback anyway.

The EUR/USD pair has rallied again during the day on Wednesday, as we continue to see a lot of bullish pressure. The 1.25 level above looms large of course, as it is a large, round, psychologically significant number. Ultimately, I believe that eventually the markets could break out to the upside and go much higher, but it will probably take a certain amount of bullish pressure to finally make that move. Once we make a fresh, new high, it’s likely that we will continue to drive towards the 1.27 level, and then eventually the 1.30 level.

Looking at the longer-term charts, we have broken above a bullish flag, suggesting that we are going to move to the 1.32 handle longer term. It’s going to take a while to get there, but along the way we should get several opportunities to pick up value on pullbacks. I believe that the trajectory of the US dollar is lower in general, and this of course is one of the most common places to go against the greenback. I anticipate several attempts will be made a break above the 1.25 level, but once we finally do, we should take off to the upside.

If we broke down below the 1.23 level, I think that the market would break down towards the 1.21 level, but that seems to be the least likely of scenarios. That would involve a complete change of attitude in the Forex markets overall, something that I don’t see happening currently. The one exception could be some type of geopolitical event.

Euro to Dollar Forecast Video 01.02.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement