Advertisement

Advertisement

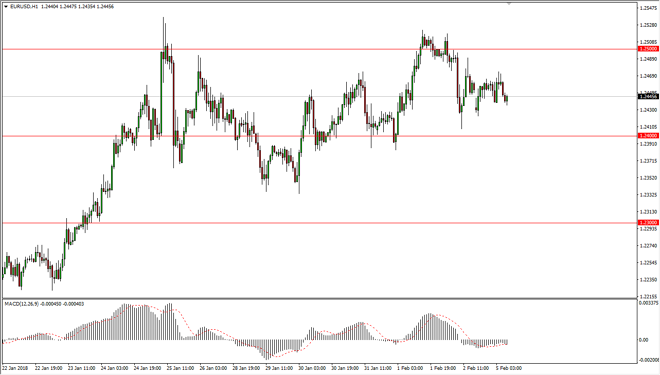

EUR/USD Price Forecast February 6, 2018, Technical Analysis

Updated: Feb 6, 2018, 05:19 GMT+00:00

The EUR/USD pair has been very quiet over the last 24 hours and looks likely to sit sideways for a while. This is because I believe we are trying to build up momentum for the next move, with a massive resistance barrier just above.

The EUR/USD pair is resistant above, as it is a large, round, psychologically significant level that will attract a lot of attention. If we can break above the 1.25 handle for a couple of hours, it’s likely that the buyers will jump into this market and continue to push towards the 1.26 level next. This pair is very technically driven, and as you can see there have been reactions to every large handle. The 1.25 level is a bit more psychologically important than some of the other ones around this area, so it makes sense that we will see a lot of noise around that area.

The bond markets of course are starting to move the Forex markets also, so keep an eye on whereby Neo to go, as higher bond yields will sometimes attract currency, and that could put a bit of an anchor around the neck of this pair. That might be the one thing that’s been keeping the pair from rallying at this point, as treasuries are starting to sell off in the United States, offering higher yields. Pay attention to German bonds as well, does that has the same effect.

We have been rallying for a while, so the occasional pullback should be expected, but if you keep your trading position reasonably sized, you can ride out the volatility that is sure to be a mainstay of this pair as so many high-frequency traders trade it. I still have an upward bias, but I also recognize that volatility is going to be high around these levels.

EUR USD Forecast Video 06.02.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement