Advertisement

Advertisement

EUR/USD Price Forecast January 11, 2018, Technical Analysis

Updated: Jan 11, 2018, 05:12 GMT+00:00

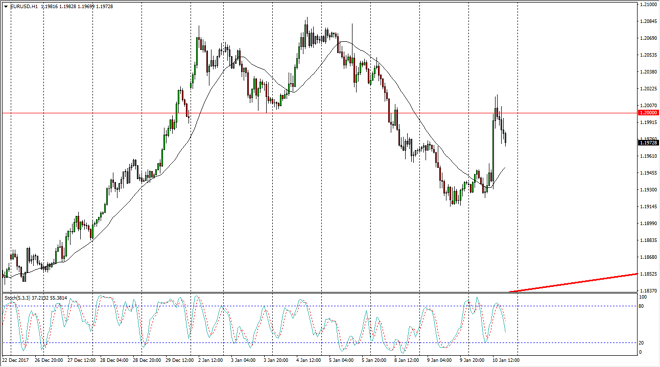

The EUR/USD pair initially was quiet during Wednesday trading, but then rallied towards the 1.20 level before finding selling pressure again. I expect to see more volatility, and ultimately it is very likely that we will see lots of noise.

The EUR/USD pair has been very noisy over the last several weeks, and as you can see during the Wednesday session, the buyers came in and started buying with force. The 1.20 level has offered a bit of resistance, but at the end of the day I think we will sliced through the level again. The reaction of negative pressure wasn’t much of a surprise, this is an area that was previous support, so it should now be resistance, but I believe that it’s only a matter of time before the buyers come in and breakthrough. If we can break above the top of the candle’s signing of the 1.20 level, I think it’s a sign that we will make another serious attempt at the 1.21 level after that.

I suspect that the volatility will continue to be a major issue, but longer-term I think that the buyers will take over, as the US dollar looks to be a bit soft longer term. This of course can change, and I think that it will be interesting to see what’s going on in the bond market, as yields are starting to rise in America, but we also have good news for the Euro as the ECB looks likely to be tightening monetary policy in the future. If there is more of a “risk on” attitude around the world, that should help this pair as well, as it dries money away from the treasury markets. For me, I’m a buyer of dips but I don’t see the bounce yet that I want to take advantage of. I suspect that the 1.19 level will continue to offer support.

Euro to Dollar Forecast Video 11.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement