Advertisement

Advertisement

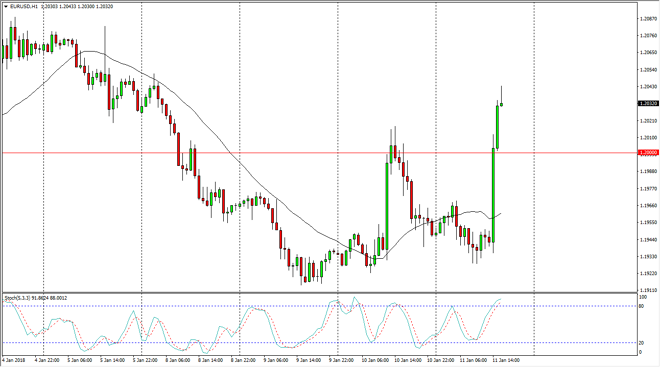

EUR/USD Price Forecast January 12, 2018, Technical Analysis

Updated: Jan 12, 2018, 04:55 GMT+00:00

The EUR/USD pair exploded to the upside during the trading session on Thursday, slicing through the 1.20 level. It looks as if the uptrend is trying to continue, as we have made a “higher high” on the short-term charts.

The EUR/USD pair broke out to the upside during the trading session on Thursday, breaking above the 1.20 level above, which of course is a large, round, psychologically significant figure. By breaking above that level, it looks as if the market is ready to go back towards the highs of the 1.21 handle again. This being the case, I believe that pullbacks offer short-term buying opportunities, but I also recognize that this pair will continue to be very noisy.

If we can break above the 1.21 level, the market should continue to go to the upside based upon the longer-term charts. We had recently broken above the top of the bullish flag on the weekly chart, and now it looks likely that we are getting ready to go higher. I think that pullbacks offer value the people will be willing to take advantage of, as the US dollar looks very vulnerable for 2018. Because of this, I believe that this market will eventually go looking towards the 1.25 handle, probably sometime this summer. In the meantime, looking at pullbacks as value is probably the best way to go, and adding slowly on your way higher is probably the best trading strategy.

I believe that the 1.19 level underneath is massively supportive, but if we break down below there I think there’s even more support at the 1.18 handle underneath, as it is a market that has seen several important levels broken in the past to the upside. It’s going to be volatile, but that’s because this is the realm of high-frequency trading.

EURUSD analysis Video 12.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement