Advertisement

Advertisement

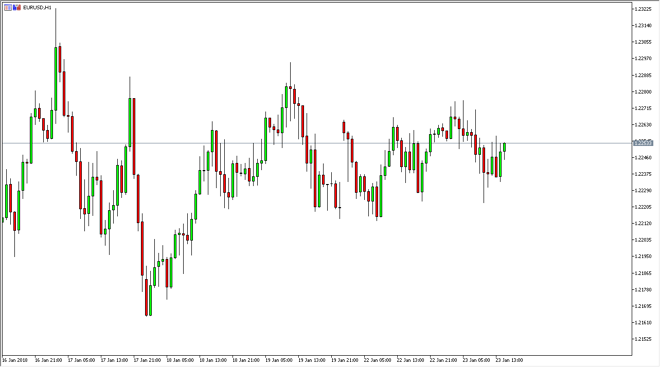

EUR/USD Price Forecast January 24, 2018, Technical Analysis

Updated: Jan 24, 2018, 04:43 GMT+00:00

The EUR/USD pair has been very choppy during the trading session on Tuesday, as the 1.2225 level has offered a bit of support. The pair has been in an uptrend for some time, and now that we have filled the gap from a couple of days ago, we could have buyers coming back in.

The EUR/USD pair has initially fallen during the day on Tuesday but found enough support near the 1.2225 level to turn around and show signs of life. If we can break above the 1.23 level, then the market will be free to go higher. Keep in mind that the pair is in an uptrend and has recently exploded to the upside. However, over the last couple of days it has been more consolidation than anything else. This of course makes sense, because the momentum had gotten so far out of line with reality. Although this market is bullish, you can’t go straight up in the air without pulling back.

I suspect that this market is simply waiting to build up the necessary momentum to sliced through the 1.25 handle above and continue the overall uptrend. I believe that short-term pullbacks will offer plenty of support below, and at this point I have no interest in shorting this market if we remain above the 1.20 level underneath. For me, that is the absolute “floor” in the market, so therefore it gives a great binary signal, meaning that below there we are sellers, and above it we are buyers.

This isn’t to say that I don’t think we can break down a bit from here, we certainly can. However, I recognize that we have recently had a massive breakout, so I think that we will eventually see traders wanting to join the fray, but right now I think were essentially treading water, trying to build up the necessary momentum to make that move.

EUR/USD Forecast Video 24.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement