Advertisement

Advertisement

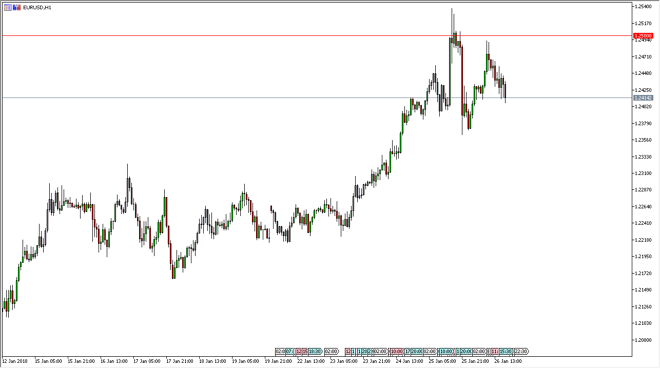

EUR/USD Price Forecast January 29, 2018, Technical Analysis

Updated: Jan 27, 2018, 05:36 GMT+00:00

The EUR/USD pair has been volatile on Friday, initially reaching the 1.25 handle, but then pulled back significantly. If we can break above the 1.25 level on a daily close, the I think that the market is ready to go much higher, giving us an opportunity to reach towards the 1.30 level.

The EUR/USD pair continues to bounce around just below the 1.25 handle, with the 1.24 level offering a bit of support. The market continues to be very volatile based upon the large, round, psychologically significant number above, and that of course attract a lot of attention. If we can break above the 1.25 level, I think at that point the market is likely to eventually go looking towards the 1.30 level, and possibly the 1.32 level based upon a bullish flag that had broken out on the weekly charge. I don’t have any interest in shorting this market, I think it is far too bullish and I think the anti-US dollar sentiment continues to be a major issue.

In fact, I believe that if we can stay above the 1.20 level, the uptrend is very much intact, but I would be surprised to see this market go that low. The marketplace continues to see a lot of volatility, but the overall attitude continues to be strong and bullish. I like buying dips and adding slowly. Eventually, we should break out to the upside, and continue to go much higher. I think that adding slowly is the best way to go, as we have seen such resiliency. Once we break out, we could have a large position, and therefore take advantage of what looks to be an almost predestined move. The market breaking down the seems to be very unlikely, but if we did I think the market could continue to go much lower. I suspect that’s about a 5% chance.

EUR/USD Video 29.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement